Georgia Pearce

Guest Reporter

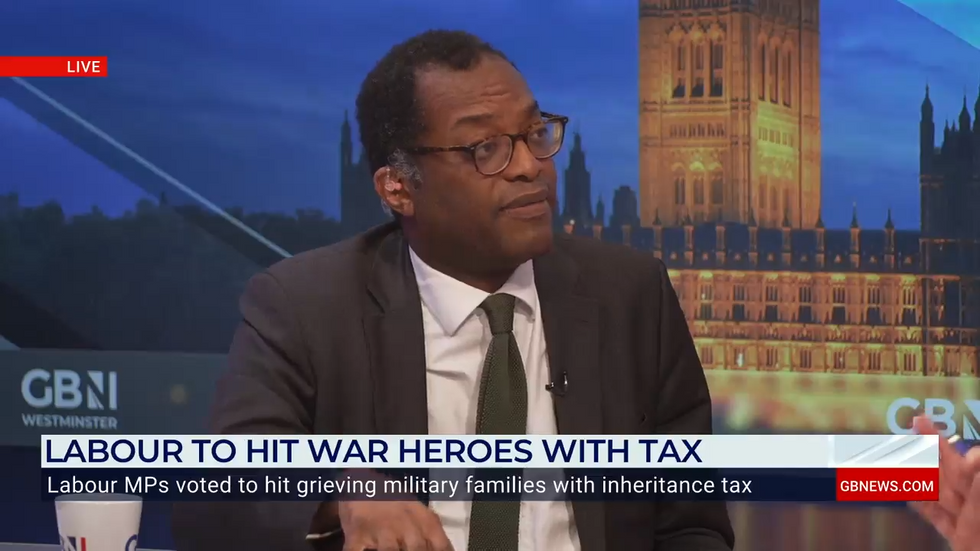

Former Chancellor Kwasi Kwarteng has branded Labour's plans to impose inheritance tax on military families as "total insanity", warning the measure would raise "nothing" for the Treasury.

Speaking to GB News, Kwarteng criticised the policy that will affect death-in-service payments for Armed Forces personnel from April 2027.

"The fiscal benefit you get from that is tiny compared to the impact, the moral impact, the impact on people's well-being," the former Chancellor said.

He argued the policy targets "people whose loved ones have fought or are willing to fight to preserve the independence of our country."

Under the new rules, children and unmarried partners of deceased service personnel will be required to pay inheritance tax on death-in-service payments if not left to a spouse or civil partner.

The payments, typically amounting to four times the late individual's salary, could be reduced by up to 40 per cent in tax.

The changes will affect military personnel who die while "off duty" - such as from sudden illness or accident. Those who die "on duty" will continue to benefit from separate tax-free arrangements.

Kwarteng suggested the policy emerged "from the bowels of officialdom" and was simply rubber-stamped by ministers without proper consideration.

"We're in this crazy world where the Government doesn't have much money to provide for public services," he said.

LATEST DEVELOPMENTS:

The former Chancellor criticised officials for scrutinising every aspect of the tax code to "wring as much money out of the public."

"They've done this because it makes the system fairer but of course they haven't looked at the human impact," Kwarteng added.

He highlighted the sacrifice of those who "put their lives in real danger in the service of their country", criticising the latest "crazy idea" of the Labour Government.

A Treasury spokesman has defended the policy, noting that existing inheritance tax protections would remain for active service deaths.

"We value the immense sacrifice made by our brave Armed Forces, that is why existing inheritance tax exemptions will continue to apply," the spokesman said.

The exemptions will cover deaths from wounds, accidents or diseases contracted on active service.

The spokesman added that any pension funds left to a spouse or civil partner in these scenarios would also remain exempt from inheritance tax.

However, Major General Neil Marshall, chief executive of the Forces Pension Society, has warned the rule change would be "corrosive" and damage trust between Armed Forces personnel and the Government.

Find Out More...

Speaking to GB News, Kwarteng criticised the policy that will affect death-in-service payments for Armed Forces personnel from April 2027.

"The fiscal benefit you get from that is tiny compared to the impact, the moral impact, the impact on people's well-being," the former Chancellor said.

He argued the policy targets "people whose loved ones have fought or are willing to fight to preserve the independence of our country."

Under the new rules, children and unmarried partners of deceased service personnel will be required to pay inheritance tax on death-in-service payments if not left to a spouse or civil partner.

The payments, typically amounting to four times the late individual's salary, could be reduced by up to 40 per cent in tax.

The changes will affect military personnel who die while "off duty" - such as from sudden illness or accident. Those who die "on duty" will continue to benefit from separate tax-free arrangements.

Kwarteng suggested the policy emerged "from the bowels of officialdom" and was simply rubber-stamped by ministers without proper consideration.

"We're in this crazy world where the Government doesn't have much money to provide for public services," he said.

LATEST DEVELOPMENTS:

- ‘I am absolutely FUMING!’ SAS veteran blasts ‘imbecilic’ Rachel Reeves as Labour target war heroes with inheritance tax raid

- Labour to force grieving military families to pay inheritance tax in 'corrosive' rule change

- Inheritance tax warning: Grieving families risk 90% tax hit as Reeves’s pension death tax looms

The former Chancellor criticised officials for scrutinising every aspect of the tax code to "wring as much money out of the public."

"They've done this because it makes the system fairer but of course they haven't looked at the human impact," Kwarteng added.

He highlighted the sacrifice of those who "put their lives in real danger in the service of their country", criticising the latest "crazy idea" of the Labour Government.

A Treasury spokesman has defended the policy, noting that existing inheritance tax protections would remain for active service deaths.

"We value the immense sacrifice made by our brave Armed Forces, that is why existing inheritance tax exemptions will continue to apply," the spokesman said.

The exemptions will cover deaths from wounds, accidents or diseases contracted on active service.

The spokesman added that any pension funds left to a spouse or civil partner in these scenarios would also remain exempt from inheritance tax.

However, Major General Neil Marshall, chief executive of the Forces Pension Society, has warned the rule change would be "corrosive" and damage trust between Armed Forces personnel and the Government.

Find Out More...