Adam Hart

Guest Reporter

Chancellor Reeves’ plan to tax farmers to plug the ‘black hole’ has been dealt a hammer blow by Britain’s independent financial watchdog today.

Reeves slapped previously exempt farmers with 20 per cent tax on assets over £1million in her October budget, sparking outcry from asset-rich but cash-poor farmers.

The Chancellor argued it was a ‘fair and balanced’ way to raise money to fill the £22billion black hole, but farmers, rural lobby groups and tax experts have said it will wipe out farmers’ profits for a decade.

Rural folk also warned the tax would lead to many farmers simply selling up, damaging the UK’s food security and inviting faceless foreign companies to buy up British land as they won’t pay massive IHT bills every forty or so years and can use the land for bogus offsetting schemes.

Defra Secretary Steve Reed has been defending the government’s policy, repeatedly stating it will only affect 500 or so farms a year.

That number has been heavily contested with several experts dismantling the Treasury’s calculations.

While arguments about numbers played out in meeting rooms, two huge tractor protests gridlocked central London, farmers cancelled machinery orders and paused investment plans, harming rural economies.

With the best tax advice for the last 30 years being to keep the farm until death, Reeves’ tax- which came with no prior warning- left many elderly farmers scrambling to transfer their farm to their children under the seven-year gifting rule, a deeply troubling and stressful time for older farmers who are worrying they may die and penalise their kids.

In a fresh blow to the Chancellor, the independent Office for Budget Responsibility (OBR) has branded the Treasury’s ‘costing’ of the policy as ‘highly uncertain’, casting sever doubt on whether it will raise any money at all.

“The main driver of uncertainty is the behavioural response to the measure, given the range of options potentially available,” said the report.

Since Reeves’ tax sparked such outrage, the government have been busy advising farmers on how not to pay their new tax, for which options include gifting it to their spouse/children over seven years.

Critics have pointed out this is not an option for many farmers who are widows, do not have children or do not have children interested in farming or are old enough to farm.

Moreover, once the farm is gifted, the giver is no longer allowed to enjoy its benefits, meaning widowed farmers who have transferred their farm would not be allowed to live on it anymore.

This is just one element of a possible behavioural reaction to the tax. With so many moving parts, it is no doubt the OBR has found the Treasury’s costing to be highly uncertain.

This is a huge blow as the policy was (by the Treasury’s estimation) set to raise just £520million a year by 2030, enough to fund the NHS for one day.

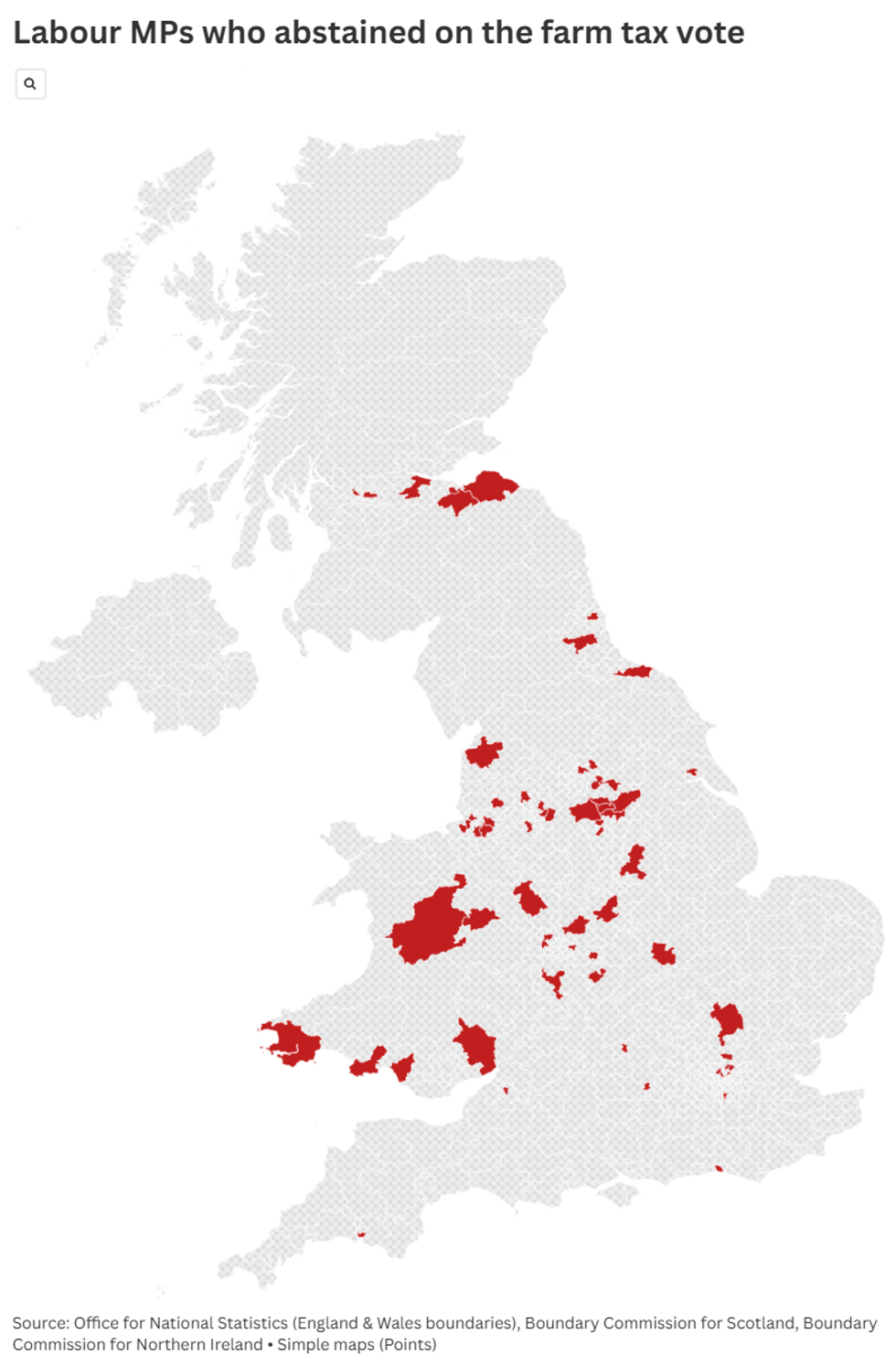

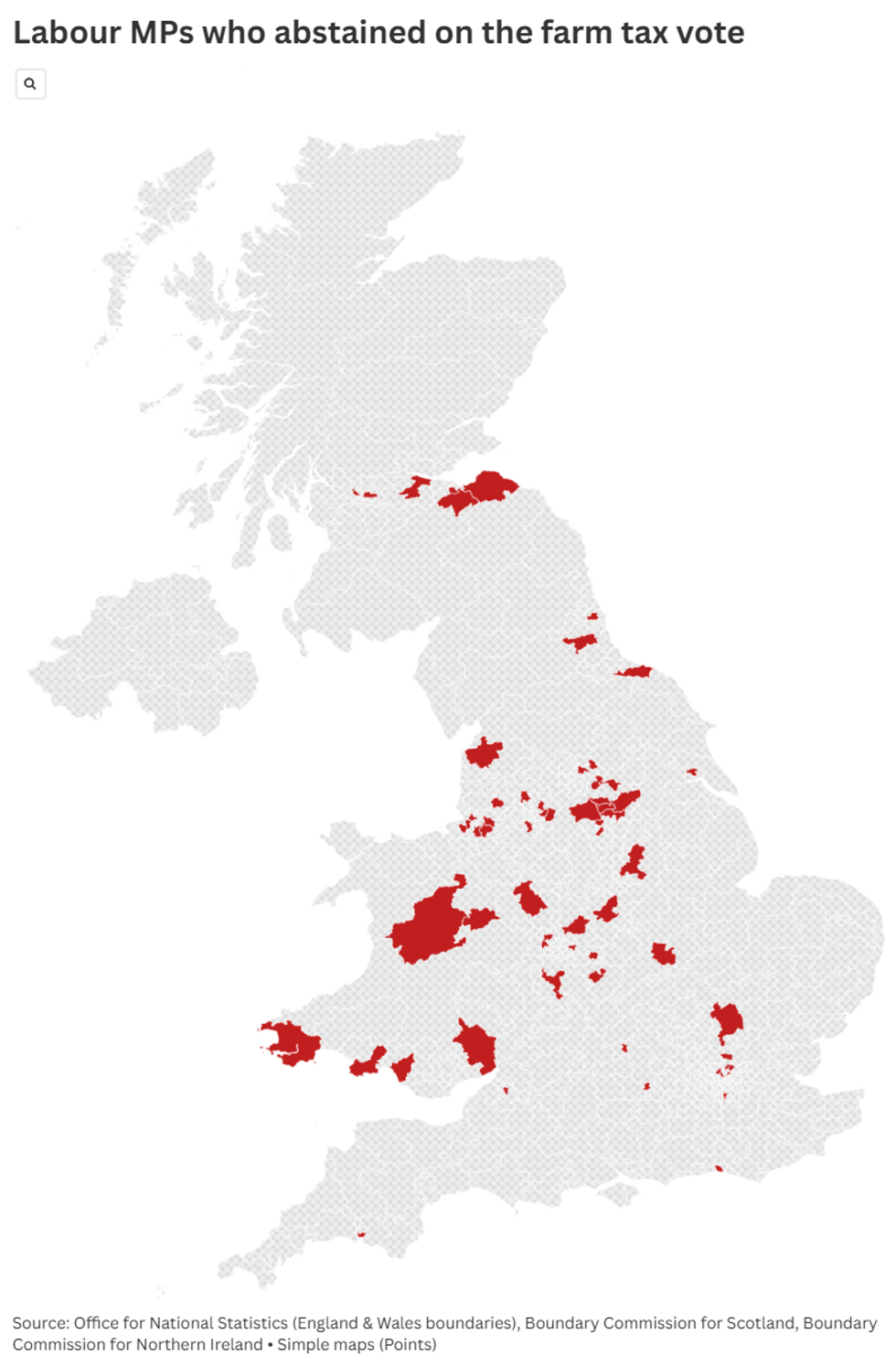

This number is fifty times less than the amount Reeves will rake in via her hike to Employers’ NI hike but has generated severe criticism and seen Labour’s polling in rural areas crash.

The watchdog also found ‘moderate uncertainty’ around the data used in the Treasury’s costing.

Critics have said this because the Treasury’s analysis was based on one year’s worth of farmers’ inheritance tax relief claims, too short a period to reveal the full effect, and failed to look at farms across Britain.

They have also pointed out the Treasury only analysed relief claims made under Agricultural Property Relief (APR) scheme.

Farmers also use the Business Property Relief (BPR) to shield assets from inheritance tax like combine harvesters that can cost up to £750,000. Reeves plans to cap BPR relief at £1million.

LATEST FROM MEMBERSHIP:

Reacting to the OBR’s report, Victoria Vyvyan, President of the Country Land and Business Association, said: “It is clear that neither the Treasury nor the Office of Budget Responsibility (OBR) has fully considered the impact on the economy of these tax reforms.

“Ministers have repeatedly said that the OBR had certified their claims, but the truth is that the OBR themselves say there is a high degree of uncertainty as to how much money will be raised, if any at all.

“But we do know that farmers and small business owners are pulling investment, cancelling machinery orders and considering whether their businesses are viable for the long-term.

“This means fewer jobs, less food security, less growth and less money going into the Exchequer to pay for public services. Government must put these reforms out to a meaningful consultation, so that Treasury can truly understand the damage they are doing.”

Victoria Atkins, shadow Defra Secretary, said: “The OBR has demonstrated that the Chancellor's reasoning is completely flawed; Labour must now axe the family farm tax.”

The Treasury and Defra have been approached for comment.

Find Out More...

Reeves slapped previously exempt farmers with 20 per cent tax on assets over £1million in her October budget, sparking outcry from asset-rich but cash-poor farmers.

The Chancellor argued it was a ‘fair and balanced’ way to raise money to fill the £22billion black hole, but farmers, rural lobby groups and tax experts have said it will wipe out farmers’ profits for a decade.

Rural folk also warned the tax would lead to many farmers simply selling up, damaging the UK’s food security and inviting faceless foreign companies to buy up British land as they won’t pay massive IHT bills every forty or so years and can use the land for bogus offsetting schemes.

Defra Secretary Steve Reed has been defending the government’s policy, repeatedly stating it will only affect 500 or so farms a year.

That number has been heavily contested with several experts dismantling the Treasury’s calculations.

While arguments about numbers played out in meeting rooms, two huge tractor protests gridlocked central London, farmers cancelled machinery orders and paused investment plans, harming rural economies.

With the best tax advice for the last 30 years being to keep the farm until death, Reeves’ tax- which came with no prior warning- left many elderly farmers scrambling to transfer their farm to their children under the seven-year gifting rule, a deeply troubling and stressful time for older farmers who are worrying they may die and penalise their kids.

In a fresh blow to the Chancellor, the independent Office for Budget Responsibility (OBR) has branded the Treasury’s ‘costing’ of the policy as ‘highly uncertain’, casting sever doubt on whether it will raise any money at all.

“The main driver of uncertainty is the behavioural response to the measure, given the range of options potentially available,” said the report.

Since Reeves’ tax sparked such outrage, the government have been busy advising farmers on how not to pay their new tax, for which options include gifting it to their spouse/children over seven years.

Critics have pointed out this is not an option for many farmers who are widows, do not have children or do not have children interested in farming or are old enough to farm.

Moreover, once the farm is gifted, the giver is no longer allowed to enjoy its benefits, meaning widowed farmers who have transferred their farm would not be allowed to live on it anymore.

This is just one element of a possible behavioural reaction to the tax. With so many moving parts, it is no doubt the OBR has found the Treasury’s costing to be highly uncertain.

This is a huge blow as the policy was (by the Treasury’s estimation) set to raise just £520million a year by 2030, enough to fund the NHS for one day.

This number is fifty times less than the amount Reeves will rake in via her hike to Employers’ NI hike but has generated severe criticism and seen Labour’s polling in rural areas crash.

The watchdog also found ‘moderate uncertainty’ around the data used in the Treasury’s costing.

Critics have said this because the Treasury’s analysis was based on one year’s worth of farmers’ inheritance tax relief claims, too short a period to reveal the full effect, and failed to look at farms across Britain.

They have also pointed out the Treasury only analysed relief claims made under Agricultural Property Relief (APR) scheme.

Farmers also use the Business Property Relief (BPR) to shield assets from inheritance tax like combine harvesters that can cost up to £750,000. Reeves plans to cap BPR relief at £1million.

LATEST FROM MEMBERSHIP:

- Beware the Boriswave migration surge: Britain now faces a 'ticking time bomb'

- Britain could have solved the energy crisis 70 years ago, but we ignored it - Lady Judith McAlpine

- REVEALED: The scandalous climate bill that will give Labour UNCHALLENGED power to pursue net zero

Reacting to the OBR’s report, Victoria Vyvyan, President of the Country Land and Business Association, said: “It is clear that neither the Treasury nor the Office of Budget Responsibility (OBR) has fully considered the impact on the economy of these tax reforms.

“Ministers have repeatedly said that the OBR had certified their claims, but the truth is that the OBR themselves say there is a high degree of uncertainty as to how much money will be raised, if any at all.

“But we do know that farmers and small business owners are pulling investment, cancelling machinery orders and considering whether their businesses are viable for the long-term.

“This means fewer jobs, less food security, less growth and less money going into the Exchequer to pay for public services. Government must put these reforms out to a meaningful consultation, so that Treasury can truly understand the damage they are doing.”

Victoria Atkins, shadow Defra Secretary, said: “The OBR has demonstrated that the Chancellor's reasoning is completely flawed; Labour must now axe the family farm tax.”

The Treasury and Defra have been approached for comment.

Find Out More...