Georgia Pearce

Guest Reporter

Labour's latest car crash for British drivers has been branded "backwards", as new tax changes are being introduced today which could see motorists slapped with astonishing £5,500 pounds road tax fees for driving certain vehicles.

Chancellor Rachel Reeves introduced the new first year Vehicle Excise Duty (VED) rates during the autumn Budget in October, which are due to be begin on April 1.

The most significant impact falls on owners of electric vehicles priced over £40,000, who now face the "Expensive Car Supplement" - commonly known as the luxury car tax.

This additional charge will cost EV owners approximately £2,200 over five years on top of standard rates.

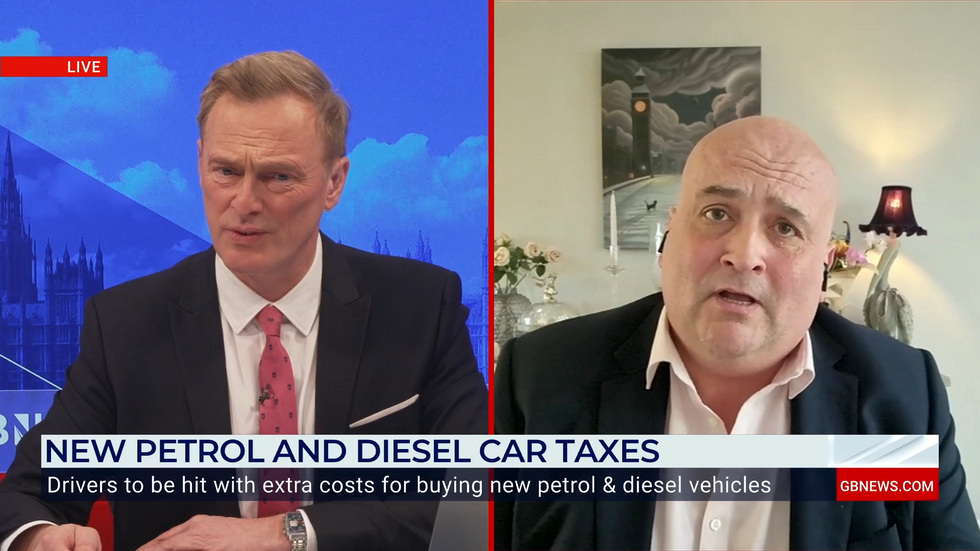

Speaking to GB News, motoring journalist Danny Kelly claimed that the 1.4 million electric car drivers who were "driving around rather smugly without having to pay any road tax" are the clear "losers" with these new changes.

Kelly highlighted the inconsistencies in the new system, noting: "Electric cars registered after the 31st of March 2017 have gone up from zero vehicle excise duty road tax to £195."

In contrast, owners of identical vehicles purchased before this date will pay significantly less.

"Electric car drivers who own a vehicle, the same model Tesla, the same colour Tesla, but they bought it pre-March 31st, 2017, that road tax is only £20," Kelly pointed out.

LATEST DEVELOPMENTS:

This creates what he described as "peculiarities" and "inconsistencies" in the tax structure.

Kelly warned that the changes create a disincentive for electric vehicle ownership: "The Chancellor did freeze fuel duty in the Autumn statement, and that was a boost in the arm for petrol and diesel drivers.

"But what she was trying to do was make the disparity between owning an electric car and an internal combustion engine car a little less attractive, so this is going backwards."

He added: "A lot of people are now thinking, well, why should I drive an electric car?"

Hitting out at the Expensive Car Supplement, Kelly warned that drivers could potentially be hit with more than "£2,000" in tax costs if motorists choose to purchase a new electric vehicle.

Kelly told GB News: "Electric cars now attract what's called a luxury showroom tax. Anything over £40,000 automatically will add on over £2,200 for the first five years of road tax.

"So you've got your £195, and then the Government will weld on nearly £2,200 over five years, if you choose to own the car. So there's a disincentive now.

"And the lucky car drivers, they're going to have their green credentials tested, because one of the reasons to drive an electric car previously was that you didn't have to pay any road tax, and now you're welded on nearly two and a half grand if you buy a new electric car over £40,000."

Find Out More...

Chancellor Rachel Reeves introduced the new first year Vehicle Excise Duty (VED) rates during the autumn Budget in October, which are due to be begin on April 1.

The most significant impact falls on owners of electric vehicles priced over £40,000, who now face the "Expensive Car Supplement" - commonly known as the luxury car tax.

This additional charge will cost EV owners approximately £2,200 over five years on top of standard rates.

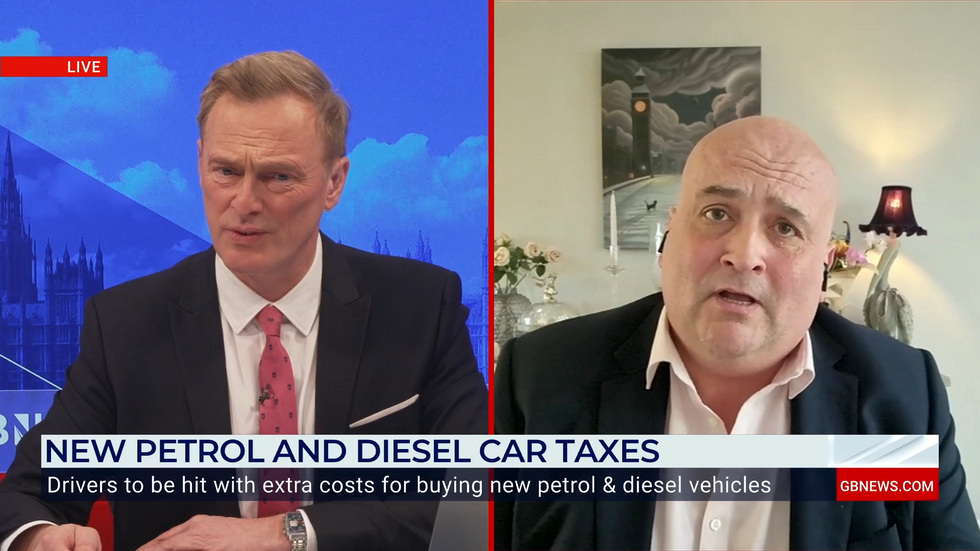

Speaking to GB News, motoring journalist Danny Kelly claimed that the 1.4 million electric car drivers who were "driving around rather smugly without having to pay any road tax" are the clear "losers" with these new changes.

Kelly highlighted the inconsistencies in the new system, noting: "Electric cars registered after the 31st of March 2017 have gone up from zero vehicle excise duty road tax to £195."

In contrast, owners of identical vehicles purchased before this date will pay significantly less.

"Electric car drivers who own a vehicle, the same model Tesla, the same colour Tesla, but they bought it pre-March 31st, 2017, that road tax is only £20," Kelly pointed out.

LATEST DEVELOPMENTS:

- Drivers of certain vehicle types to get £25,000 off new models

- Rachel Reeves kicks off 'Awful April' with new £425 'luxury' car tax hikes penalising millions

- Petrol, diesel and electric vehicle owners to see huge car tax hikes today with millions impacted

This creates what he described as "peculiarities" and "inconsistencies" in the tax structure.

Kelly warned that the changes create a disincentive for electric vehicle ownership: "The Chancellor did freeze fuel duty in the Autumn statement, and that was a boost in the arm for petrol and diesel drivers.

"But what she was trying to do was make the disparity between owning an electric car and an internal combustion engine car a little less attractive, so this is going backwards."

He added: "A lot of people are now thinking, well, why should I drive an electric car?"

Hitting out at the Expensive Car Supplement, Kelly warned that drivers could potentially be hit with more than "£2,000" in tax costs if motorists choose to purchase a new electric vehicle.

Kelly told GB News: "Electric cars now attract what's called a luxury showroom tax. Anything over £40,000 automatically will add on over £2,200 for the first five years of road tax.

"So you've got your £195, and then the Government will weld on nearly £2,200 over five years, if you choose to own the car. So there's a disincentive now.

"And the lucky car drivers, they're going to have their green credentials tested, because one of the reasons to drive an electric car previously was that you didn't have to pay any road tax, and now you're welded on nearly two and a half grand if you buy a new electric car over £40,000."

Find Out More...