Hemma Visavadia

Guest Reporter

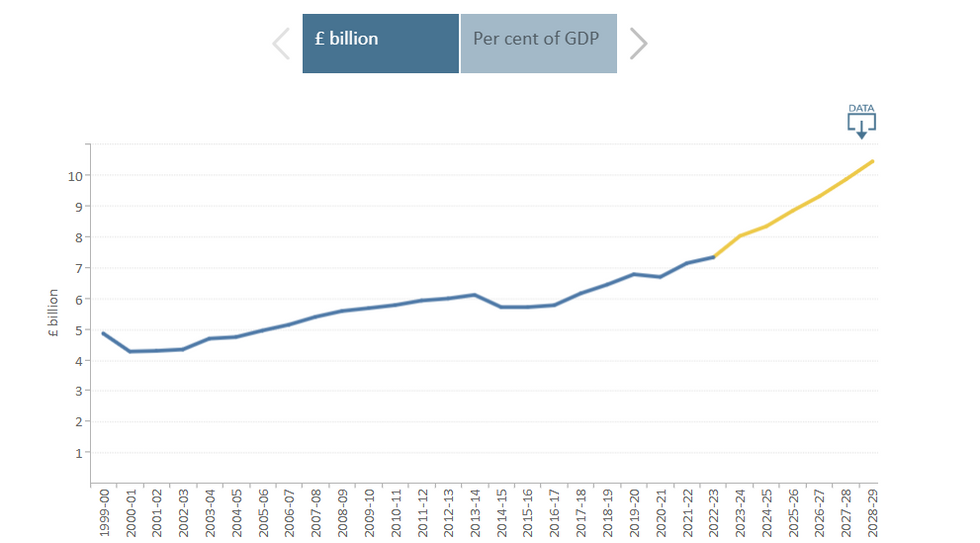

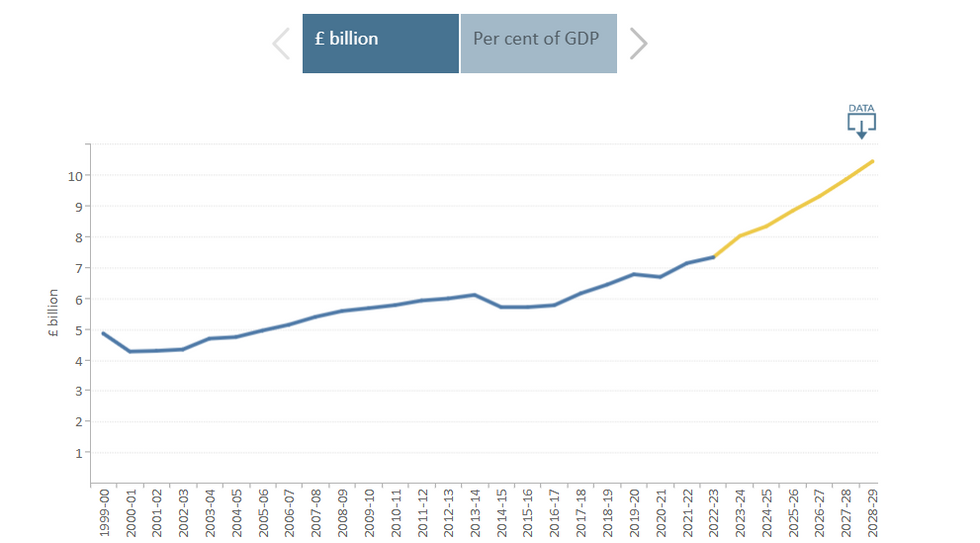

Rachel Reeves car tax changes for electric vehicles are set to raise £8.8billion next year for the Government, according to analysis by the Office for Budget Responsibility (OBR).

The tax reforms announced during the Budget will come into effect from April 2025 and will end the current exemption for electric vehicles through the introduction of new charges.

The OBR reported that the additional revenue from electric cars will represent 0.7 per cent of all receipts and equate to approximately £290 per household.

The changes mark a significant shift in vehicle taxation policy, with electric vehicles registered after April 1, 2025, being required to pay road tax for the first time.

Do you have a story you'd like to share? Get in touch by emailing [email protected]

The move comes as part of broader reforms to create what experts describe as a more “equitable” taxation system across all vehicle types.

From April 2025, newly registered electric vehicles will initially be charged the lowest rate of £10 for their first year on the road.

After the first year, EV owners will transition to the standard Vehicle Excise Duty rate, currently set at £190 annually.

The new structure aligns with the Government's broader vehicle taxation framework, where first-year payments are typically related to CO2 emissions, while subsequent years follow a standardised rate.

The changes will affect all electric vehicles first registered on or after April 1 2017, bringing them in line with the taxation system for petrol and diesel cars.

Similar changes will also apply to zero-emissions vans and motorcycles under the new regime. A significant change will also affect luxury electric vehicles through the end of the Expensive Car Supplement exemption.

From April 2025, drivers of electric vehicles priced over £40,000 will face an additional £410 charge for five years.

This surcharge will apply alongside the standard VED rates, marking the end of special treatment for premium electric vehicles.

The change aims to ensure tax fairness across all vehicle categories, regardless of their powertrain type. This means owners of higher-priced electric vehicles will need to factor in both the standard VED rate and the luxury supplement in their annual motoring costs.

Car expert Darren Miller from BigWantsYourCar.com explained the changes aim to "make taxes fairer for all types of vehicles" while promoting sustainability.

For conventional vehicles registered before April 2017, VED payments are primarily determined by CO2 emissions, with drivers of fuel-efficient cars paying as little as £30 in their first year.

Less efficient vehicles face significantly higher charges, reaching up to £2,605 for the most polluting models.

LATEST DEVELOPMENTS:

Miller added that these changes support "sustainable mobility solutions in the UK" despite the increased costs.

He explained: “By ensuring that EV owners contribute their share to road infrastructure costs, policymakers lay the groundwork for a fairer and more sustainable transportation system.”

Find Out More...

The tax reforms announced during the Budget will come into effect from April 2025 and will end the current exemption for electric vehicles through the introduction of new charges.

The OBR reported that the additional revenue from electric cars will represent 0.7 per cent of all receipts and equate to approximately £290 per household.

The changes mark a significant shift in vehicle taxation policy, with electric vehicles registered after April 1, 2025, being required to pay road tax for the first time.

Do you have a story you'd like to share? Get in touch by emailing [email protected]

The move comes as part of broader reforms to create what experts describe as a more “equitable” taxation system across all vehicle types.

From April 2025, newly registered electric vehicles will initially be charged the lowest rate of £10 for their first year on the road.

After the first year, EV owners will transition to the standard Vehicle Excise Duty rate, currently set at £190 annually.

The new structure aligns with the Government's broader vehicle taxation framework, where first-year payments are typically related to CO2 emissions, while subsequent years follow a standardised rate.

The changes will affect all electric vehicles first registered on or after April 1 2017, bringing them in line with the taxation system for petrol and diesel cars.

Similar changes will also apply to zero-emissions vans and motorcycles under the new regime. A significant change will also affect luxury electric vehicles through the end of the Expensive Car Supplement exemption.

From April 2025, drivers of electric vehicles priced over £40,000 will face an additional £410 charge for five years.

This surcharge will apply alongside the standard VED rates, marking the end of special treatment for premium electric vehicles.

The change aims to ensure tax fairness across all vehicle categories, regardless of their powertrain type. This means owners of higher-priced electric vehicles will need to factor in both the standard VED rate and the luxury supplement in their annual motoring costs.

Car expert Darren Miller from BigWantsYourCar.com explained the changes aim to "make taxes fairer for all types of vehicles" while promoting sustainability.

For conventional vehicles registered before April 2017, VED payments are primarily determined by CO2 emissions, with drivers of fuel-efficient cars paying as little as £30 in their first year.

Less efficient vehicles face significantly higher charges, reaching up to £2,605 for the most polluting models.

LATEST DEVELOPMENTS:

- Labour insists it will support Blue Badge holders despite huge theft numbers - ‘Appalling’

- DVLA sees sharp increase in number of drivers having licences 'immediately' taken for breaking driving law

- Motorists could be pushed off roads by environmental taxes and Rachel Reeves charges coming in next year

Miller added that these changes support "sustainable mobility solutions in the UK" despite the increased costs.

He explained: “By ensuring that EV owners contribute their share to road infrastructure costs, policymakers lay the groundwork for a fairer and more sustainable transportation system.”

Find Out More...