Adam Hart

Guest Reporter

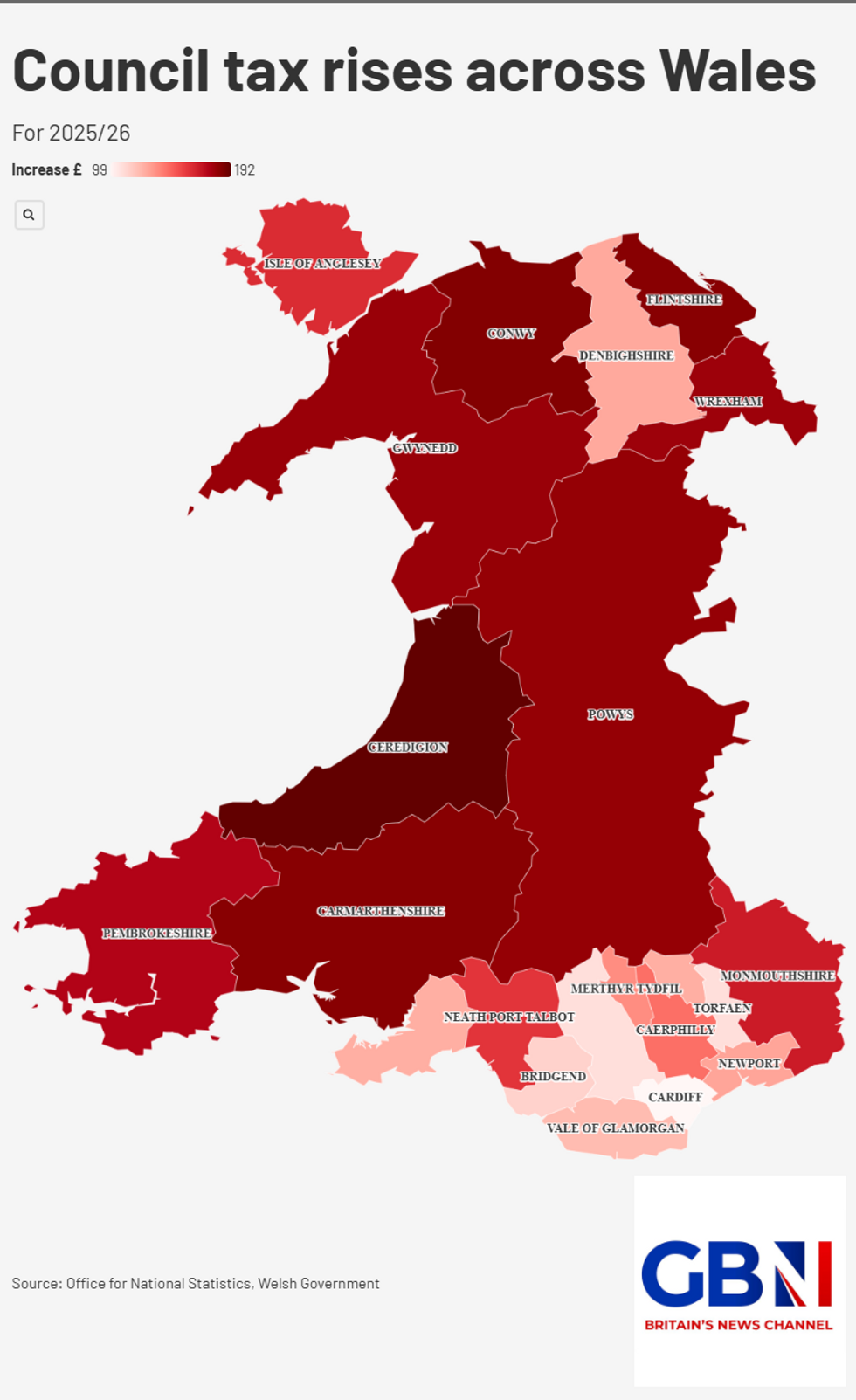

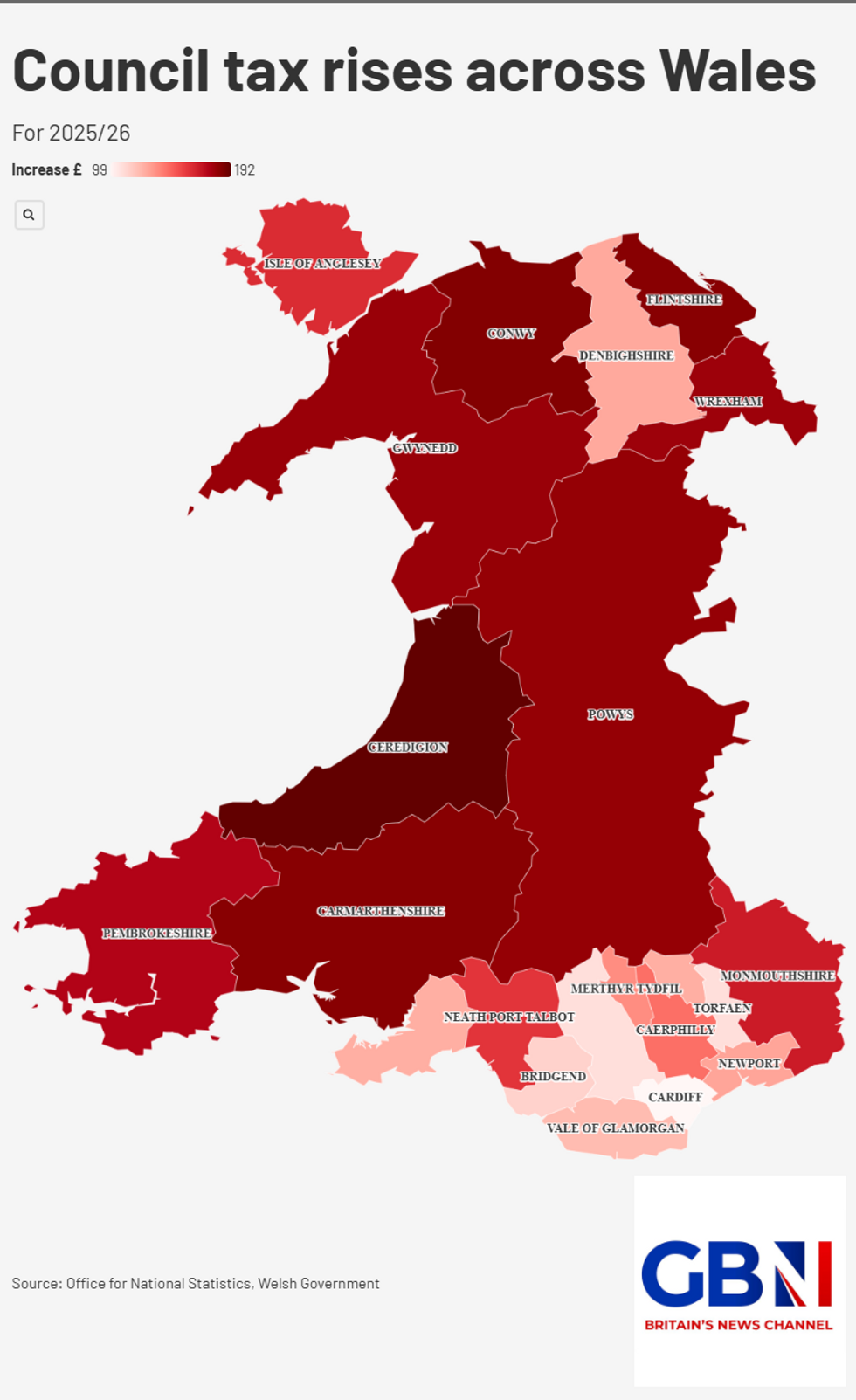

All 22 of Wales’ authorities are hiking council tax for 2025/26 by hundreds of pounds, a shocking map has revealed.

Despite £253 million extra funding from the Welsh government, Welsh councils are enacting some of the largest increases in Britain with bills rising by a hefty average of £145 for Band D properties.

This is £36 more than the average rise across England (£109).

Seven councils in Wales are Labour controlled, three are Plaid Cymru and one is independent while the remaining 11 are under ‘no overall control’, though within most of these Labour is the largest party.

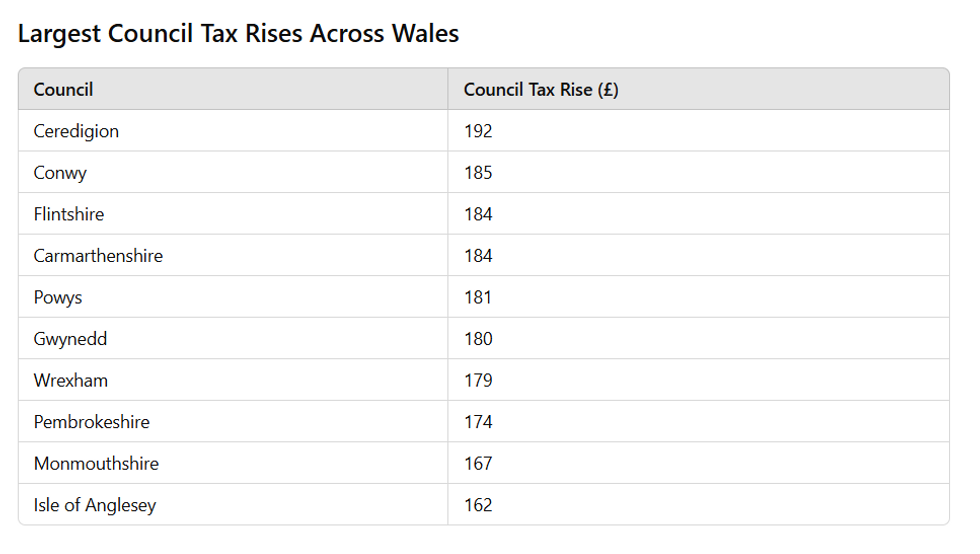

The areas with the largest increases are Ceredigion (up £192), Conwy (up £185) and Flintshire (up £184).

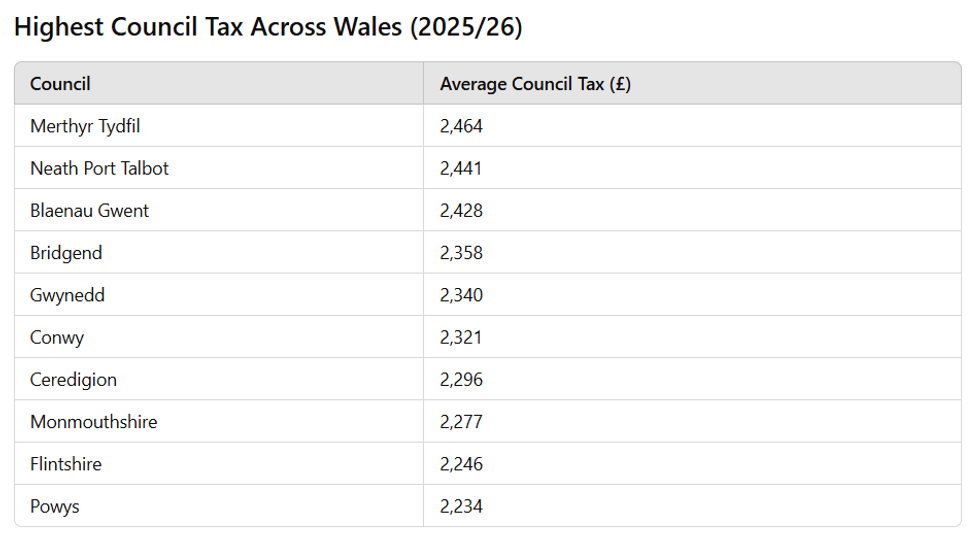

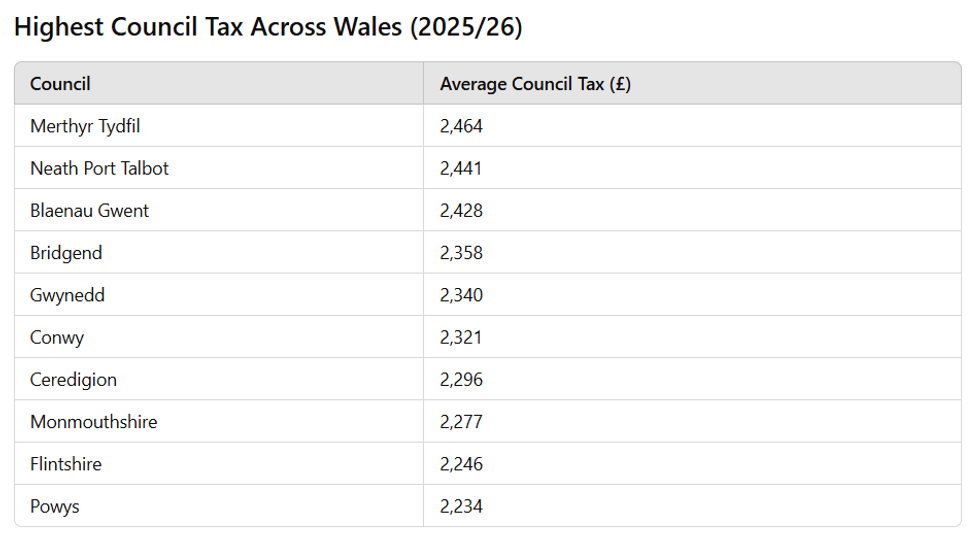

However, these counties still do not have the highest council tax rates for 2025/26. Merthyr Tydfil (£2,464), Neath Port Talbot (£2,441) and Blaenau Gwent (£2,428) make up the top three for overall council tax charges.

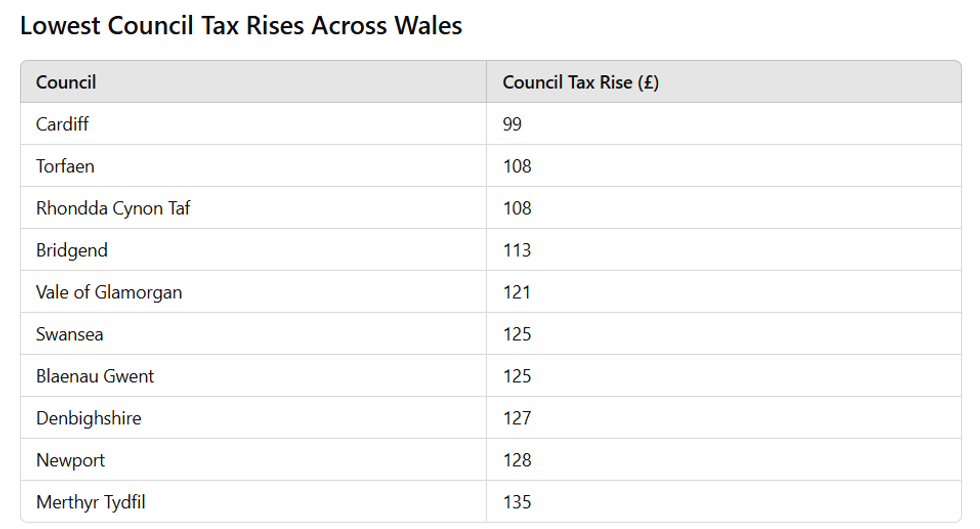

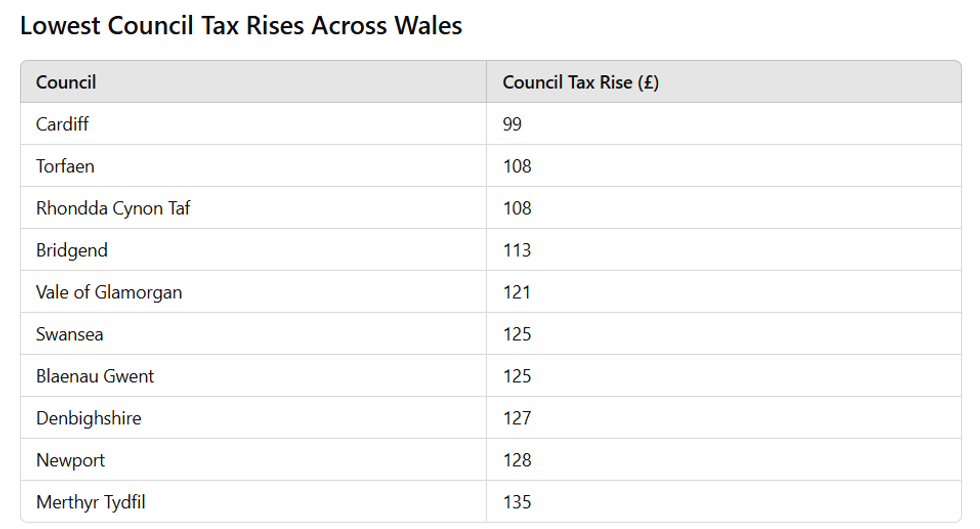

On the other hand, Cardiff (up £99), Rhondda Cynon Taf (up £108) and Torfaen (up £108) have the smallest rises for 2025/26.

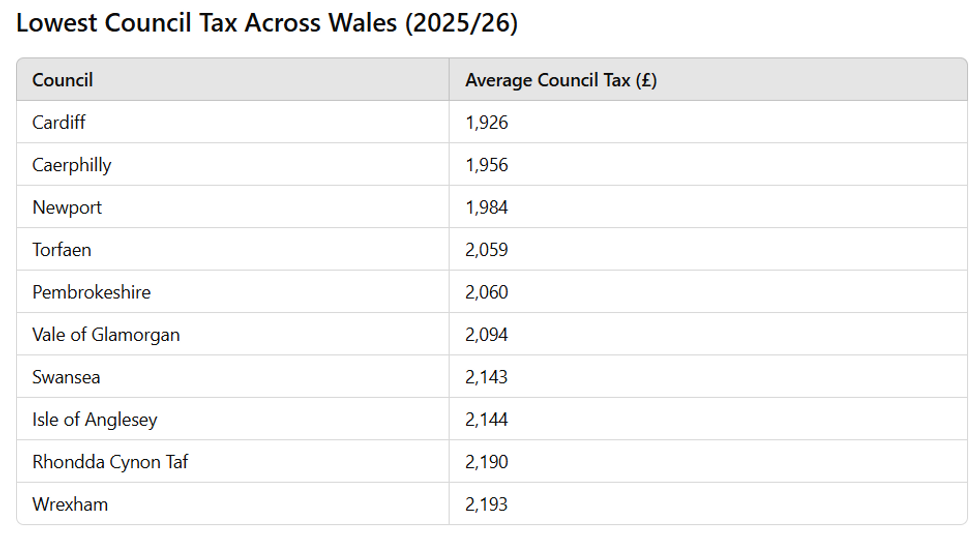

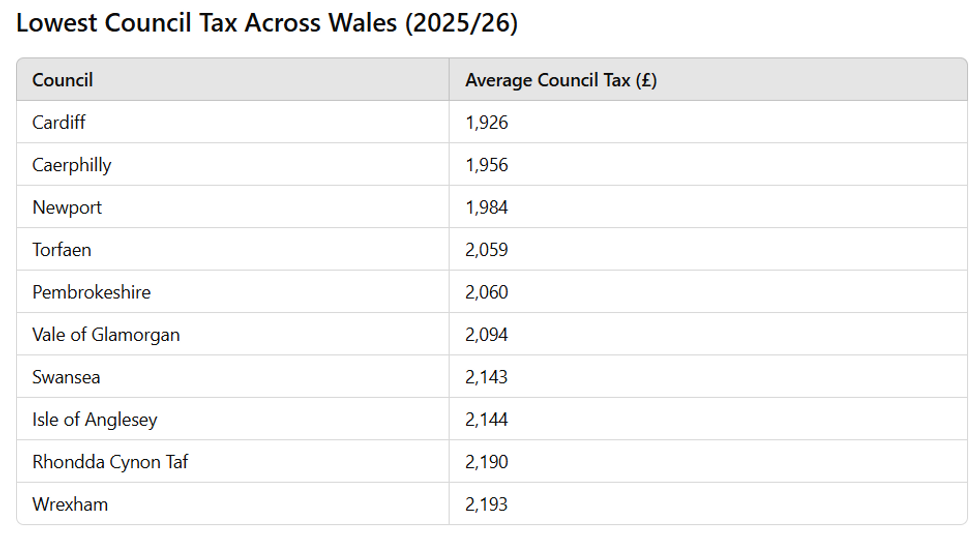

In terms of which authority will have the lowest charge next year, Wales’ cities occupy two of the top three spots with Cardiff (£1,926) the cheapest, Caerphilly (£1,956) second and Newport (£1,984) third.

Across the Celtic Nation, the rises mean council tax yearly charges now average a record £2,170 for an average Band D property.

This is marginally lower than England whose average Band D property charge for 2025/26 will be £2,280- £110 higher.

In Scotland, council tax has been frozen since 2007, meaning average Band D charges are £1,421 for 2024/25, almost £1,000 lower than England and Wales.

However, this year authorities have finally raised bills with 13 areas agreeing rises of 10 per cent or more. The Scottish government has announced £1billion extra funding for councils, so bills will still be much lower than the rest of England.

Northern Ireland uses a domestic rates system instead of council tax.

It comes after nine in ten authorities in England raised council tax by 4.99 per cent, the legal limit before a referendum must be called.

Defending the decision, councils argue they are struggling with the soaring cost of providing care and hiring staff.

Several councils applied to the government to raise council tax by more than 4.99 per cent without a referendum.

Angela Rayner, as Secretary of State for Housing, Communities and Local Government, allowed six councils to do so.

They are Bradford (10%), Newham (9%), Windsor and Maidenhead (9%), Birmingham (7.5%), Somerset (7.5%) and Trafford (7.5%).

Council tax increases are just one of many bills rising today that kick off ‘awful April’. Other charges going up today include road tax, stamp duty, employers’ national insurance contributions, water, electricity and energy.

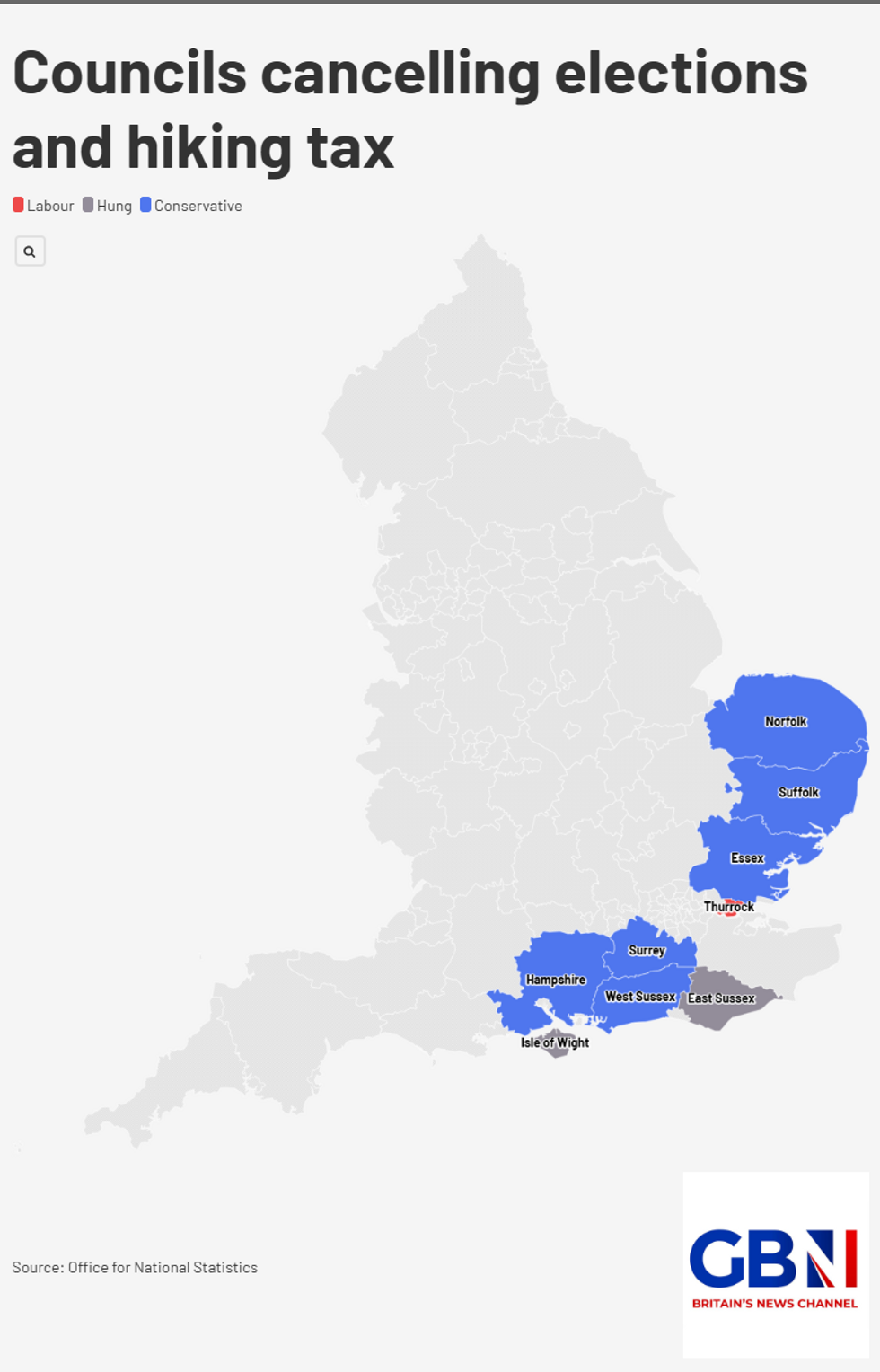

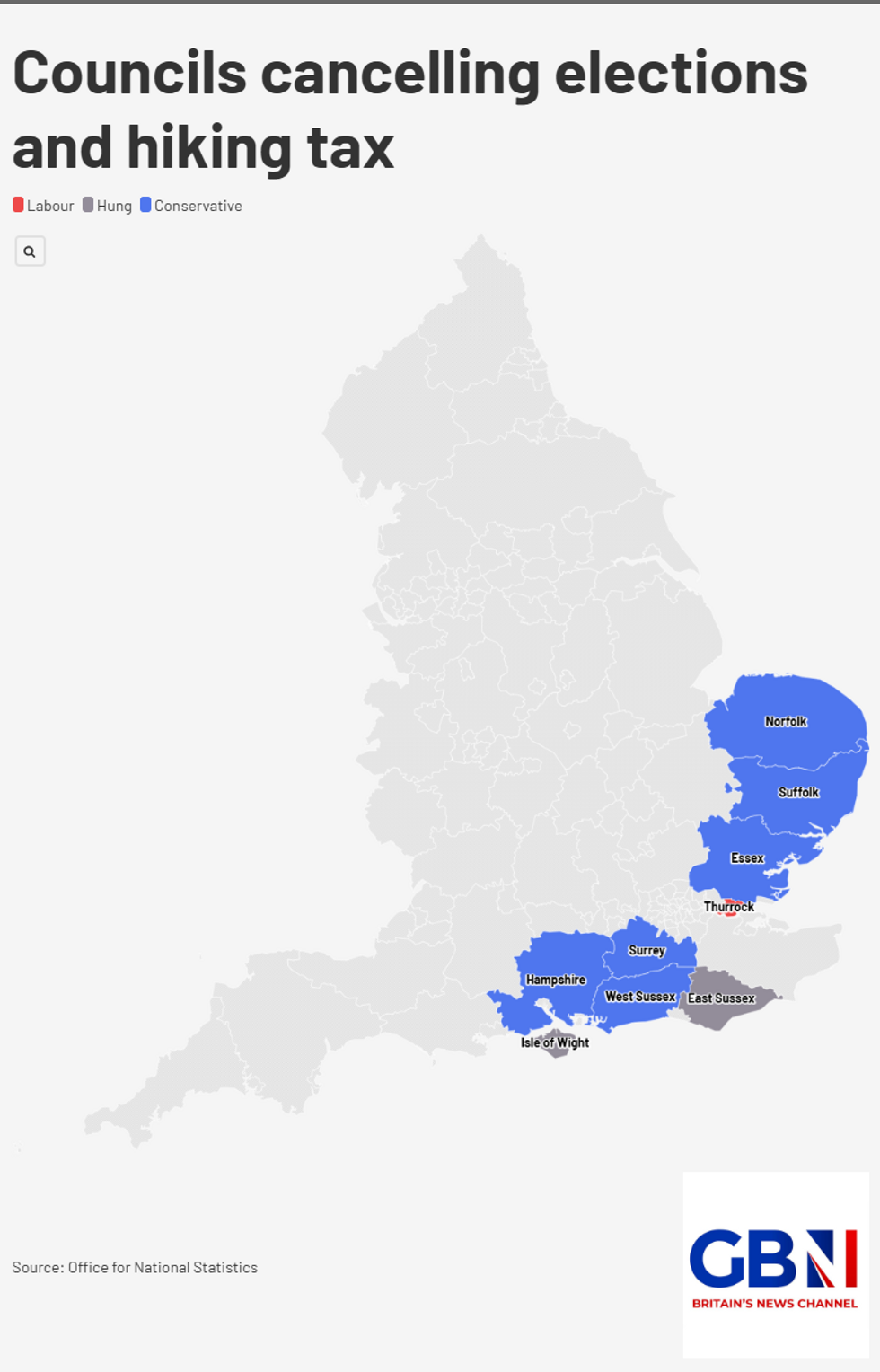

Council tax increases are a particular sore point in areas where local elections have been cancelled as Labour looks to shakeup local government.

All nine authorities where elections are cancelled are raising bills. They are:

Isle of Wight - £118.46 rise (Council Tax 2025/26: £2492.46)

Thurrock - £101.85 rise (Council Tax 2025/26: £2142.80)

East Sussex - £88.72 rise (Council Tax 2025/26: £1866.72)

West Sussex - £81.49 rise (Council Tax 2025/26: £1714.49)

Norfolk - £79.44 rise (Council Tax 2025/26: £1671.40)

Suffolk - £78.39 rise (Council Tax 2025/26: £1649.39)

Hampshire - £76.50 rise (Council Tax 2025/26: £1609.00)

Essex - £75.95 rise (Council Tax 2025/26: £1597.95)

Surrey - £72.70 rise (Council Tax 2025/26: £1529.70)

LATEST FROM MEMBERSHIP:

These authorities are thought to cover around 5 million people, all of whom will have no chance to protest tax bills at the ballot box.

It comes after Keir Starmer pledged to freeze council tax if his party won the election in a speech launching Labour’s local election campaign in March 2023.

The Welsh Labour Government says: “The setting of budgets and council tax are matters for the elected members in each council. We urge anyone struggling to pay council tax to contact their local council or Citizens Advice for help.”

“We are providing more than £6bn to local government through the final Local Government Settlement, as well as £1.3bn in additional specific grants. Every local authority is receiving a higher increase than in 2024-2025.”

Find Out More...

Despite £253 million extra funding from the Welsh government, Welsh councils are enacting some of the largest increases in Britain with bills rising by a hefty average of £145 for Band D properties.

This is £36 more than the average rise across England (£109).

Seven councils in Wales are Labour controlled, three are Plaid Cymru and one is independent while the remaining 11 are under ‘no overall control’, though within most of these Labour is the largest party.

EXPLORE: Wales' largest council tax rises

EXPLORE: Wales' largest council tax rises

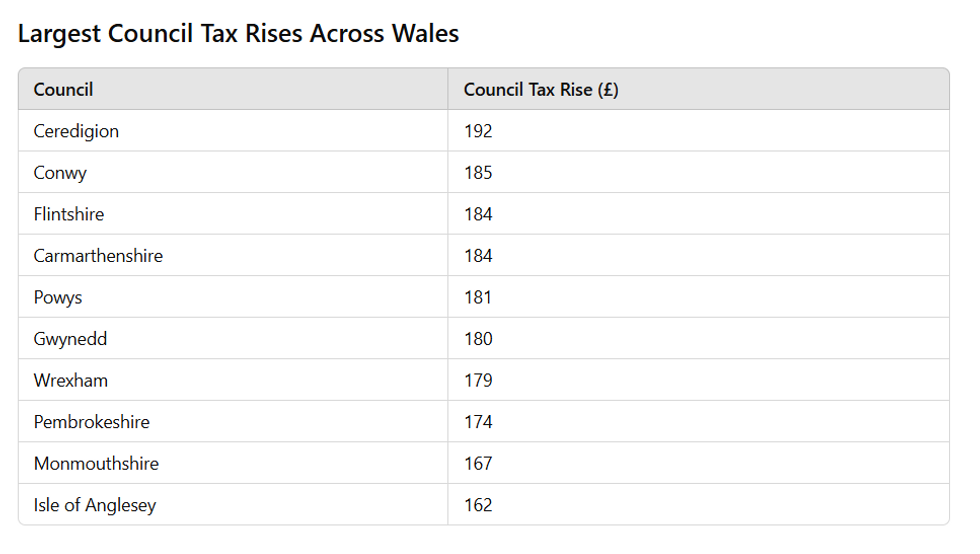

The areas with the largest increases are Ceredigion (up £192), Conwy (up £185) and Flintshire (up £184).

However, these counties still do not have the highest council tax rates for 2025/26. Merthyr Tydfil (£2,464), Neath Port Talbot (£2,441) and Blaenau Gwent (£2,428) make up the top three for overall council tax charges.

TOP TEN: Largest council tax rises across Wales

TOP TEN: Highest council tax rates across Wales

On the other hand, Cardiff (up £99), Rhondda Cynon Taf (up £108) and Torfaen (up £108) have the smallest rises for 2025/26.

In terms of which authority will have the lowest charge next year, Wales’ cities occupy two of the top three spots with Cardiff (£1,926) the cheapest, Caerphilly (£1,956) second and Newport (£1,984) third.

TOP TEN: Smallest council tax rises across Wales

TOP TEN: Lowest council tax rates across Wales

Across the Celtic Nation, the rises mean council tax yearly charges now average a record £2,170 for an average Band D property.

This is marginally lower than England whose average Band D property charge for 2025/26 will be £2,280- £110 higher.

In Scotland, council tax has been frozen since 2007, meaning average Band D charges are £1,421 for 2024/25, almost £1,000 lower than England and Wales.

However, this year authorities have finally raised bills with 13 areas agreeing rises of 10 per cent or more. The Scottish government has announced £1billion extra funding for councils, so bills will still be much lower than the rest of England.

Northern Ireland uses a domestic rates system instead of council tax.

It comes after nine in ten authorities in England raised council tax by 4.99 per cent, the legal limit before a referendum must be called.

Defending the decision, councils argue they are struggling with the soaring cost of providing care and hiring staff.

Several councils applied to the government to raise council tax by more than 4.99 per cent without a referendum.

Angela Rayner, as Secretary of State for Housing, Communities and Local Government, allowed six councils to do so.

They are Bradford (10%), Newham (9%), Windsor and Maidenhead (9%), Birmingham (7.5%), Somerset (7.5%) and Trafford (7.5%).

Council tax increases are just one of many bills rising today that kick off ‘awful April’. Other charges going up today include road tax, stamp duty, employers’ national insurance contributions, water, electricity and energy.

Council tax increases are a particular sore point in areas where local elections have been cancelled as Labour looks to shakeup local government.

All nine authorities where elections are cancelled are raising bills. They are:

Isle of Wight - £118.46 rise (Council Tax 2025/26: £2492.46)

Thurrock - £101.85 rise (Council Tax 2025/26: £2142.80)

East Sussex - £88.72 rise (Council Tax 2025/26: £1866.72)

West Sussex - £81.49 rise (Council Tax 2025/26: £1714.49)

Norfolk - £79.44 rise (Council Tax 2025/26: £1671.40)

Suffolk - £78.39 rise (Council Tax 2025/26: £1649.39)

Hampshire - £76.50 rise (Council Tax 2025/26: £1609.00)

Essex - £75.95 rise (Council Tax 2025/26: £1597.95)

Surrey - £72.70 rise (Council Tax 2025/26: £1529.70)

LATEST FROM MEMBERSHIP:

- Reform's surge is too big to be ignored - the sunny uplands beckon - Ann Widdecombe

- Harry’s latest disaster shows he & Meghan can’t hack public life without Royal Family - Lee Cohen

- ‘Our women feel threatened!’ GB News investigation exposes REALITY of migrant hotels in Crewe

These authorities are thought to cover around 5 million people, all of whom will have no chance to protest tax bills at the ballot box.

It comes after Keir Starmer pledged to freeze council tax if his party won the election in a speech launching Labour’s local election campaign in March 2023.

The Welsh Labour Government says: “The setting of budgets and council tax are matters for the elected members in each council. We urge anyone struggling to pay council tax to contact their local council or Citizens Advice for help.”

“We are providing more than £6bn to local government through the final Local Government Settlement, as well as £1.3bn in additional specific grants. Every local authority is receiving a higher increase than in 2024-2025.”

Find Out More...