Gabrielle Wilde

Guest Reporter

Sir Keir Starmer has responded to concerns raised by a 12-year-old aspiring farmer who fears his dreams of following in his family's agricultural footsteps could be dashed by proposed inheritance tax changes.

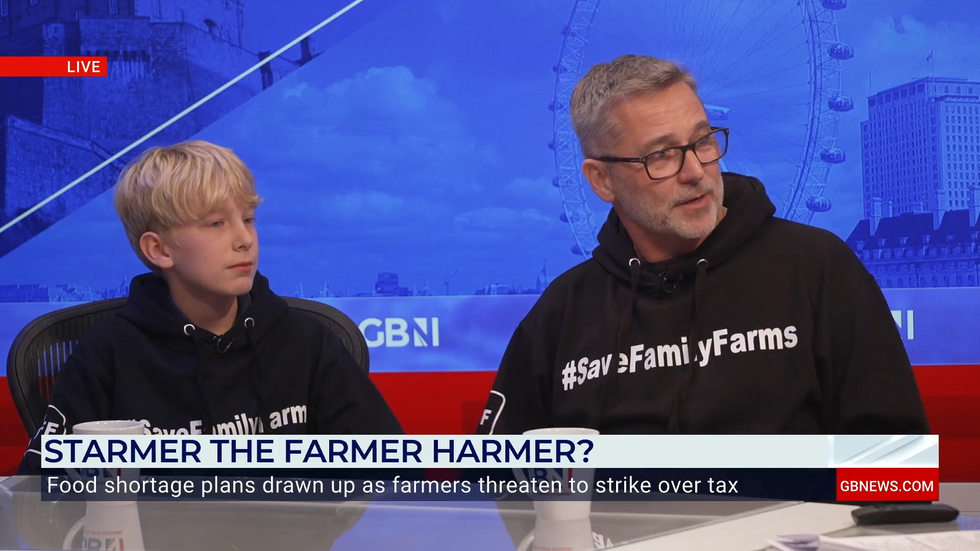

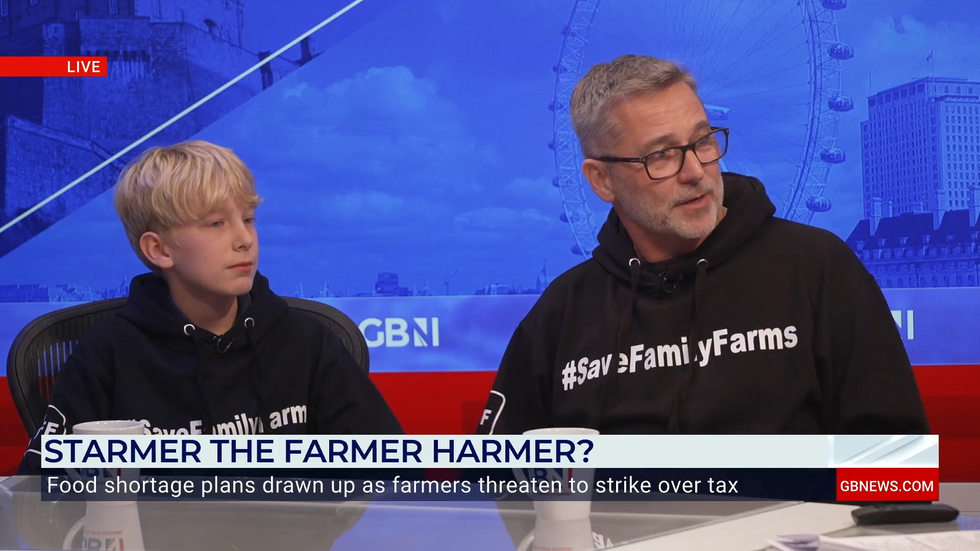

Henry Bailye appeared on GB News alongside his father Clive ahead of Tuesday's farmers' protest in London, where he made an emotional plea to the Government.

He said: "It makes me feel disappointed in the Government because they're taking away something that me and I'm guessing all of my generation opportunities to become farmers when they're older"

He added: "Think about how this affects my generation and how this affects their future of doing something they've dreamed about for years."

Speaking to GB News, the Prime Minister responded to Henry and told Christopher Hope: "I don't know the details of Henry's case, I don't know what the farm in that particular case is worth.

"Assuming it is a mum or dad passing onto Henry, then it will be under the £3million threshold so that will mean he is unaffected. I don't know the details of the particular case."

LATEST DEVELOPMENTS:

The young farmer's concerns centre on Labour's planned reforms to inheritance tax relief on agricultural property, announced by Chancellor Rachel Reeves in October.

Under the proposed changes, farms worth more than £1million would face a 20 per cent tax rate on assets above this threshold, rather than the standard 40 per cent inheritance tax rate.

Labour maintains that a typical case of parents passing a farm to their children would have a £3million threshold before the tax applies.

In an interview with GB News, Starmer added: "So it's very important for me to keep making the case that it's only farm and assets over £3million in a typical case of parents wanting to pass onto their children.

"Therefore, for that reason, I am confident that the vast majority [missing word] not be affected. But look I understand the concerns, we must have discussions.

"The minister was in discussions yesterday with the farmers. And we will continue to do so because we must support them."

Hope asked him: "Will you tweak the threshold or will you allow it over 80s not to be hit by it because they can't plan for their inheritance?"

The Prime Minister responded: "Because the threshold is high, the vast majority are unaffected.

"The other thing I would say is this, I mean I grew up in a rural area, I know first-hand that rural areas, farming communities they do need the investment that we put in the Budget to their hospitals, into their schools, into housing near where they are so their families can live.

"Therefore, the Budget itself was absolutely focused on those things.

"But the threshold at £3million is very high, the vast majority will be unaffected and we need to keep making that case because [missing word] I think the right thing to do is to meet that concern and talk it through."

Find Out More...

Henry Bailye appeared on GB News alongside his father Clive ahead of Tuesday's farmers' protest in London, where he made an emotional plea to the Government.

He said: "It makes me feel disappointed in the Government because they're taking away something that me and I'm guessing all of my generation opportunities to become farmers when they're older"

He added: "Think about how this affects my generation and how this affects their future of doing something they've dreamed about for years."

Speaking to GB News, the Prime Minister responded to Henry and told Christopher Hope: "I don't know the details of Henry's case, I don't know what the farm in that particular case is worth.

"Assuming it is a mum or dad passing onto Henry, then it will be under the £3million threshold so that will mean he is unaffected. I don't know the details of the particular case."

LATEST DEVELOPMENTS:

- Campaign Against Antisemitism to take to streets of London as hate crimes against Jews quadruple

- ‘My first job was on a farm!’ Keir Starmer hits back at concerns Labour is ‘too urban’

- Businesswoman kicked out of private Mayfair club after breaching Covid rules faces £600K in court bills

The young farmer's concerns centre on Labour's planned reforms to inheritance tax relief on agricultural property, announced by Chancellor Rachel Reeves in October.

Under the proposed changes, farms worth more than £1million would face a 20 per cent tax rate on assets above this threshold, rather than the standard 40 per cent inheritance tax rate.

Labour maintains that a typical case of parents passing a farm to their children would have a £3million threshold before the tax applies.

In an interview with GB News, Starmer added: "So it's very important for me to keep making the case that it's only farm and assets over £3million in a typical case of parents wanting to pass onto their children.

"Therefore, for that reason, I am confident that the vast majority [missing word] not be affected. But look I understand the concerns, we must have discussions.

"The minister was in discussions yesterday with the farmers. And we will continue to do so because we must support them."

Hope asked him: "Will you tweak the threshold or will you allow it over 80s not to be hit by it because they can't plan for their inheritance?"

The Prime Minister responded: "Because the threshold is high, the vast majority are unaffected.

"The other thing I would say is this, I mean I grew up in a rural area, I know first-hand that rural areas, farming communities they do need the investment that we put in the Budget to their hospitals, into their schools, into housing near where they are so their families can live.

"Therefore, the Budget itself was absolutely focused on those things.

"But the threshold at £3million is very high, the vast majority will be unaffected and we need to keep making that case because [missing word] I think the right thing to do is to meet that concern and talk it through."

Find Out More...