Gabrielle Wilde

Guest Reporter

Farmers have been left furious with one stating that "people don't understand where their food comes from" after it was revealed that Labour has defeated a Conservative motion to scrap a controversial inheritance tax change.

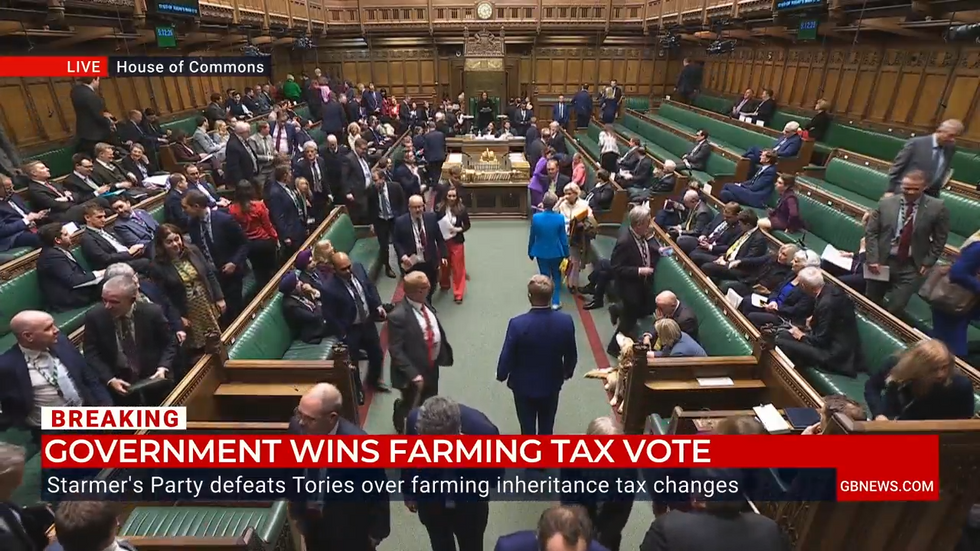

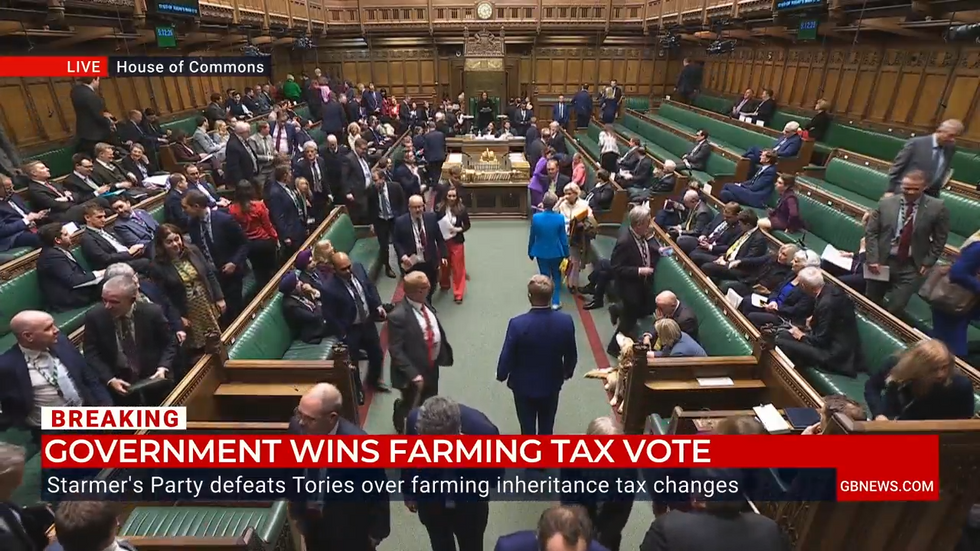

The motion was rejected in the House of Commons this afternoon with 339 MPs voting against and 181 in favour.

The defeat comes amid intense debate over Labour's new policy that will see farmers pay inheritance tax on agricultural property for the first time.

Farmers have expressed fury over the inheritance tax changes, with strong criticism of the government's approach to assessing the impact.

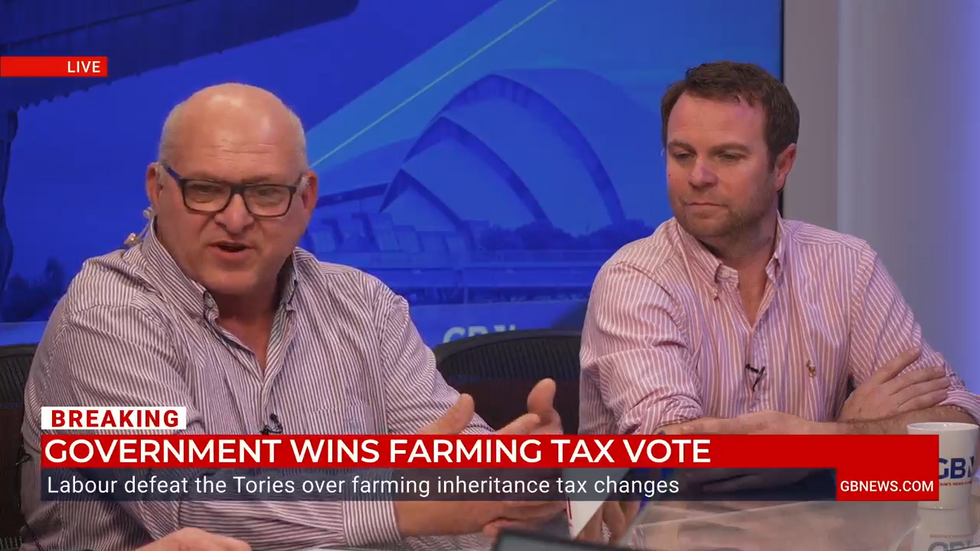

Martin Williams, a farmer, told GB News: "l think there's actually huge anger in the countryside. It's absolutely immense.

"It just seems so short-sighted of a government to not listen to the figures, the correct figures. They've been given the figures multiple times.

LATEST DEVELOPMENTS

"If they ask the question of syntax that they wanted the answer for. They may have got the right answer if they ask the correct answer based on what family farms require.

"They asked the wrong question. That is where the problem lies."

Fellow farmer Ollie Harrison furiously added: "People don't understand where their food comes from, by the looks of things.

"A lot of them, if they're in rural seats, they have just resigned in four years, haven't they."

The Conservative Party had moved to challenge the changes, which they claim could threaten the future of family farming across Britain.

Under measures announced at the Budget, farmers will now pay a 20 per cent inheritance tax on agricultural property and land worth more than £1million, where previously they paid none.

For couples passing on their farms, a higher threshold of £3m has been set.

The Treasury estimates around 500 estates per year will be affected by these changes.

However, the National Farmers' Union suggests that "some three-quarters of farms will be affected," while the Central Association of Agricultural Valuers estimates it could impact 75,000 farming business owners over a generation.

The figures have sparked heated debate between Labour and Conservative MPs over the policy's true reach.

The Government has defended its position, stating it must make "difficult decisions" in the context of what it claims is a £22billion fiscal deficit inherited from the previous Conservative administration.

Treasury minister James Murray declined to commit to any future policy review if data shows the impact is greater than anticipated.

Find Out More...

The motion was rejected in the House of Commons this afternoon with 339 MPs voting against and 181 in favour.

The defeat comes amid intense debate over Labour's new policy that will see farmers pay inheritance tax on agricultural property for the first time.

Farmers have expressed fury over the inheritance tax changes, with strong criticism of the government's approach to assessing the impact.

Martin Williams, a farmer, told GB News: "l think there's actually huge anger in the countryside. It's absolutely immense.

"It just seems so short-sighted of a government to not listen to the figures, the correct figures. They've been given the figures multiple times.

LATEST DEVELOPMENTS

- Bev Turner hits back at Labour's defence of inheritance tax raid: 'The farmers don't agree!'

- ‘Are they stupid?!’ Bev Turner erupts at Labour’s inheritance tax defence as Tories force vote

- WATCH: Lindsay Hoyle lets loose at MPs after 'absolutely disgraceful' move in the Commons

"If they ask the question of syntax that they wanted the answer for. They may have got the right answer if they ask the correct answer based on what family farms require.

"They asked the wrong question. That is where the problem lies."

Fellow farmer Ollie Harrison furiously added: "People don't understand where their food comes from, by the looks of things.

"A lot of them, if they're in rural seats, they have just resigned in four years, haven't they."

The Conservative Party had moved to challenge the changes, which they claim could threaten the future of family farming across Britain.

Under measures announced at the Budget, farmers will now pay a 20 per cent inheritance tax on agricultural property and land worth more than £1million, where previously they paid none.

For couples passing on their farms, a higher threshold of £3m has been set.

The Treasury estimates around 500 estates per year will be affected by these changes.

However, the National Farmers' Union suggests that "some three-quarters of farms will be affected," while the Central Association of Agricultural Valuers estimates it could impact 75,000 farming business owners over a generation.

The figures have sparked heated debate between Labour and Conservative MPs over the policy's true reach.

The Government has defended its position, stating it must make "difficult decisions" in the context of what it claims is a £22billion fiscal deficit inherited from the previous Conservative administration.

Treasury minister James Murray declined to commit to any future policy review if data shows the impact is greater than anticipated.

Find Out More...