Adam Chapman

Guest Reporter

The French parliament is expected to pass a no-confidence motion against Prime Minister Michel Barnier’s minority government today.

The vote of no-confidence was issued after Barnier used a rare constitutional power to force through the 2025 budget without a parliamentary vote on Tuesday.

This angered both Marine Le Pen's right-wing National Rally (RN) and an alliance of left-wing parties, who accused the government of adopting austerity measures.

The RN leader, who is expected to benefit from the turmoil, declared a vote of no confidence in Barnier “the moment of truth”.

What does this all mean for the economy?

The expectation that the no-confidence vote will pass and the minority government will fall has sent markets into free fall.

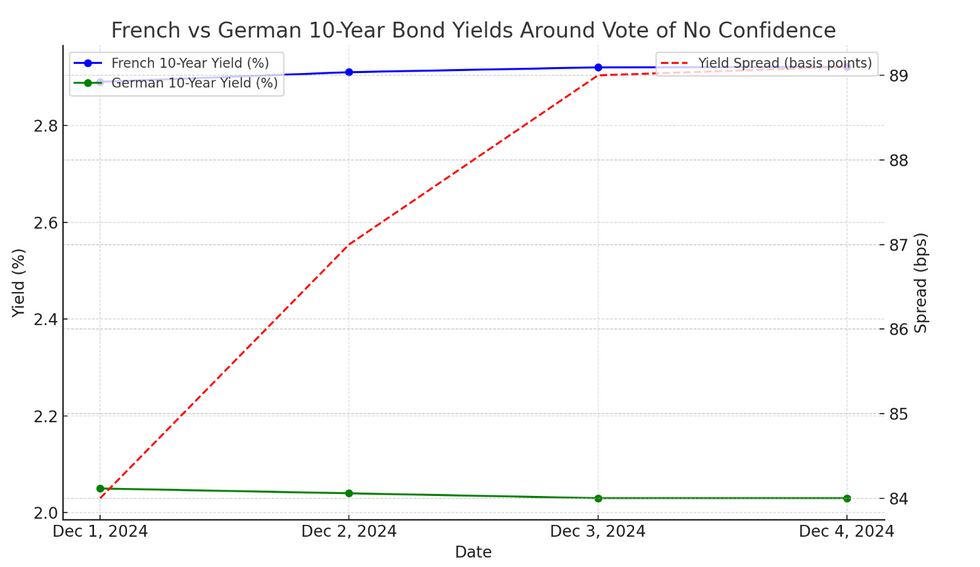

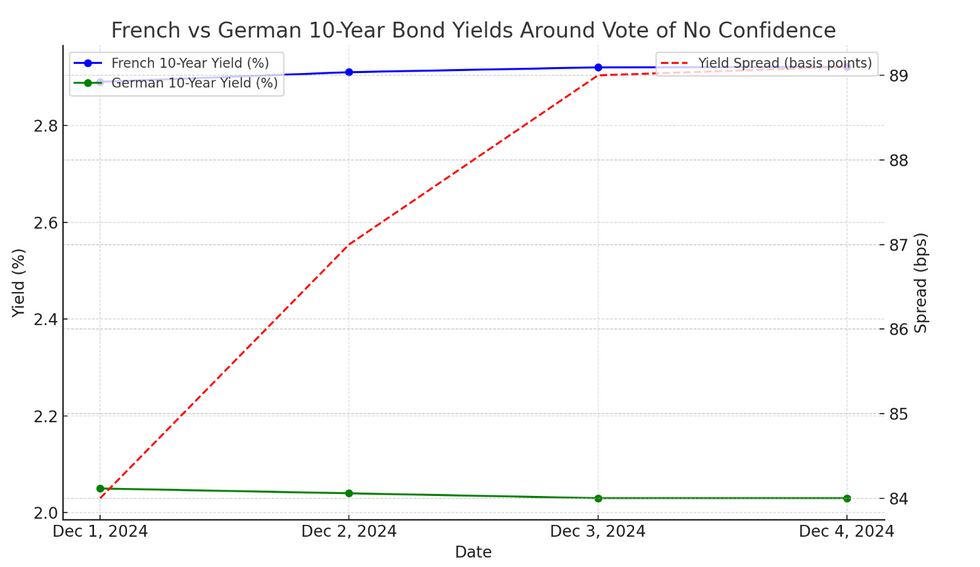

Investors punished French assets following the announcement of no-confidence motions, leading to a sell-off in French stocks and bonds.

The euro also weakened as a result, reflecting investor concerns over the political stability of France, which is the eurozone's second-largest economy.

French government bond yields rose sharply, with the premium France pays for long-term borrowing compared to Germany reaching its highest level since the Eurozone crisis in 2012.

France's risk premium even surpassed that of Greece.

If the no-confidence vote passes, this will cause further economic pain. For example, yields on French debt may rise further, increasing borrowing costs for the government and potentially for businesses.

This volatility is shaking investor confidence, but Europe's economic powerhouse has long been rigged to explode.

Data provided by Professor Juan Ramón Rallo shows that France has the largest government in the world, with state spending accounting for roughly 57 per cent of GDP.

In contrast, government spending in the US hovers around 36 per cent of their GDP - its highest was 47 per cent during 2020.

France's public-sector deficit is projected to exceed six per cent of GDP this year alone, well above the EU's target of three per cent, the economist's analysis shows.

This matters because high debt levels increase the cost of borrowing for the government, as interest payments consume a larger portion of the budget. This can crowd out other essential spending or lead to higher taxes in the future.

In addition to undermining economic growth by shaking investor confidence, large deficits can lead to austerity measures that reduce public spending, which prove politically contentious, as today's no-confidence vote shows.

LATEST MEMBERSHIP DEVELOPMENTS

The country's public debt has been increasing steadily, exacerbated by the 2008 financial crisis, the COVID-19 pandemic, and the energy crisis. Structural reforms have often been postponed, adding to fiscal pressures.

The International Monetary Fund (IMF) recently acknowledged France's dire predicament, stating that “structural reforms are necessary to ensure debt remains sustainable while maintaining growth potential”.

France’s debt surpassed 110 per cent of GDP in 2024, a level considered risky for long-term fiscal sustainability.

Barnier’s budget aimed to curb this spiralling deficit by bringing in €60billion (£49billion) in tax rises and spending cuts.

However, this incurred the wrath of Le Pen, who branded the Government's 2025 budget as “bad, unjust and violent" and criticised several aspects of its social security financing plan, which Barnier forced through yesterday.

These include cuts to employer social contributions, ending inflation-indexing tensions and plans to make the prescription drug reimbursement policy less generous.

Several left-wing parties also opposed the plan for its austerity measures, which they believe would disproportionately affect the working and middle classes, reduce the quality and accessibility of public services, and further weaken the social safety net in France.

If the vote today leads to prolonged instability or triggers early elections, the economic damage could be severe.

However, if a new government is swiftly formed and market concerns are addressed, the impact might be contained.

Much will depend on the speed and effectiveness of France's political response.

Find Out More...

The vote of no-confidence was issued after Barnier used a rare constitutional power to force through the 2025 budget without a parliamentary vote on Tuesday.

This angered both Marine Le Pen's right-wing National Rally (RN) and an alliance of left-wing parties, who accused the government of adopting austerity measures.

The RN leader, who is expected to benefit from the turmoil, declared a vote of no confidence in Barnier “the moment of truth”.

What does this all mean for the economy?

The expectation that the no-confidence vote will pass and the minority government will fall has sent markets into free fall.

Investors punished French assets following the announcement of no-confidence motions, leading to a sell-off in French stocks and bonds.

The euro also weakened as a result, reflecting investor concerns over the political stability of France, which is the eurozone's second-largest economy.

French government bond yields rose sharply, with the premium France pays for long-term borrowing compared to Germany reaching its highest level since the Eurozone crisis in 2012.

France's risk premium even surpassed that of Greece.

If the no-confidence vote passes, this will cause further economic pain. For example, yields on French debt may rise further, increasing borrowing costs for the government and potentially for businesses.

This volatility is shaking investor confidence, but Europe's economic powerhouse has long been rigged to explode.

Data provided by Professor Juan Ramón Rallo shows that France has the largest government in the world, with state spending accounting for roughly 57 per cent of GDP.

In contrast, government spending in the US hovers around 36 per cent of their GDP - its highest was 47 per cent during 2020.

France's public-sector deficit is projected to exceed six per cent of GDP this year alone, well above the EU's target of three per cent, the economist's analysis shows.

This matters because high debt levels increase the cost of borrowing for the government, as interest payments consume a larger portion of the budget. This can crowd out other essential spending or lead to higher taxes in the future.

In addition to undermining economic growth by shaking investor confidence, large deficits can lead to austerity measures that reduce public spending, which prove politically contentious, as today's no-confidence vote shows.

LATEST MEMBERSHIP DEVELOPMENTS

- MAPPED: Starmer faces fresh hell as analysis reveals where most farmers are located on election petition map

- Starmer is about to abandon his main manifesto pledge...are you paying attention?

- Ten rural Labour MPs under pressure to REBEL as Conservatives force vote on farmers tax

France, on the verge of collapse

They have the largest government in the world (About 57% of GDP is gov spending)

Risk premium is higher than the one of Greece!

Deficits at 6% of GDP

The government is about to get kicked out

Thanks to @juanrallo for the data pic.twitter.com/CccCZN8D4V

— Alberto Alvarez (@AAGresearch) December 3, 2024

The country's public debt has been increasing steadily, exacerbated by the 2008 financial crisis, the COVID-19 pandemic, and the energy crisis. Structural reforms have often been postponed, adding to fiscal pressures.

The International Monetary Fund (IMF) recently acknowledged France's dire predicament, stating that “structural reforms are necessary to ensure debt remains sustainable while maintaining growth potential”.

France’s debt surpassed 110 per cent of GDP in 2024, a level considered risky for long-term fiscal sustainability.

Barnier’s budget aimed to curb this spiralling deficit by bringing in €60billion (£49billion) in tax rises and spending cuts.

However, this incurred the wrath of Le Pen, who branded the Government's 2025 budget as “bad, unjust and violent" and criticised several aspects of its social security financing plan, which Barnier forced through yesterday.

These include cuts to employer social contributions, ending inflation-indexing tensions and plans to make the prescription drug reimbursement policy less generous.

Several left-wing parties also opposed the plan for its austerity measures, which they believe would disproportionately affect the working and middle classes, reduce the quality and accessibility of public services, and further weaken the social safety net in France.

If the vote today leads to prolonged instability or triggers early elections, the economic damage could be severe.

However, if a new government is swiftly formed and market concerns are addressed, the impact might be contained.

Much will depend on the speed and effectiveness of France's political response.

Find Out More...