Gabrielle Wilde

Guest Reporter

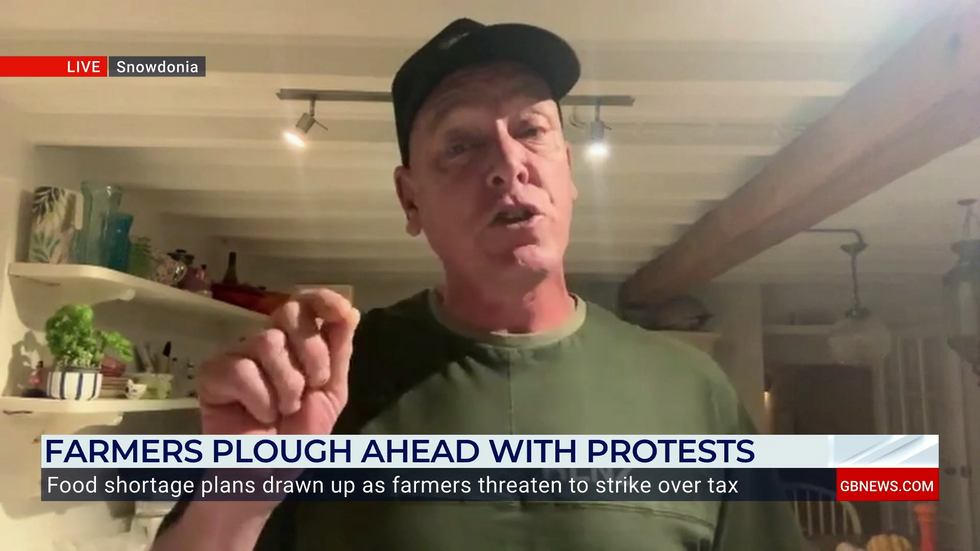

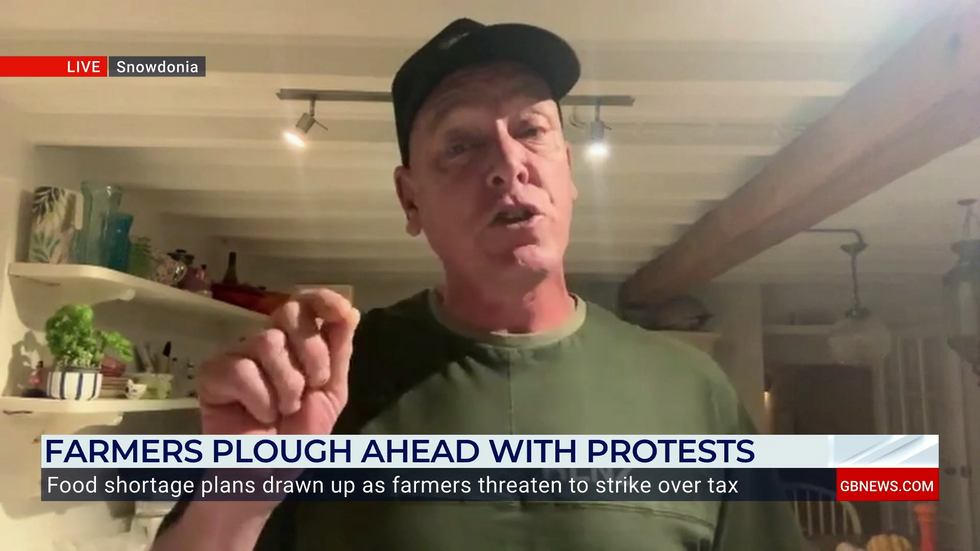

Farmer Gareth Wyn Jones has fumed at Labour for dropping the "biggest bombshell ever" and warned a "huge problem" could be on the horizon for Britain.

Sir Keir Starmer has also been criticised for avoiding protesters at the Welsh Labour conference by "sneaking out the back" rather than facing farmers who are angry about inheritance tax changes.

Hundreds of farmers gathered with tractors outside the conference venue in Llandudno to voice their dismay at the changes unveiled in Rachel Reeves' first Budget.

Farmer Gareth Wyn Jones told GB News: "They don't understand the importance of agriculture, farming and food production. If they did, they wouldn't have put this inheritance tax on small family farms.

"Starmer stood in the NFU conference in February and told everybody how he was going to protect family farms.

"The first Budget comes out and he drops the biggest bombshell ever. We should challenge him.

LATEST DEVELOPMENTS

"On Saturday where the Welsh Labour Conference was, he was there. There were hundreds of farmers and I was one of them. We waited for him outside to come and address and talk to us to aired our frustrations, but he didn't.

"He snuck out the back. That is really, really poor form. He's spending more times on airplanes all over the world instead of sorting out the problems he's got in this country.

"I'm telling you something. There is some big problems coming up from food shortages.

"This is the biggest worry for us as farmers, being able to afford to be able to feed the poor people in society, and that is going to be a problem."

Despite the protests, Starmer defended his position at the conference, saying he would "defend the tough decisions that would be necessary to stabilise our economy".

He insisted the Budget measures were needed to "face up to the harsh light of fiscal reality".

Treasury data suggests around three-quarters of farmers will pay nothing in inheritance tax under the new rules.

However, farmers have challenged these figures, citing Department for Environment Food and Rural Affairs data indicating 66 per cent of farm businesses are worth more than the £1million threshold.

Experts warn the new rules will create an unfair divide, with private sector workers' pension inheritances facing a 40 per cent tax charge while public sector pensions remain exempt.

Ian Cook of wealth manager Quilter warned the changes could have "devastating" consequences for dependent partners.

The Tax Payers Alliance criticised the growing unfairness, saying "private sector workers are sick of picking up the bill for gold-plated public sector pensions."

A government spokesperson said: “With public services crumbling, a £22bn fiscal hole inherited from the previous government and 40 per cent of Agricultural Property Relief going to the 7 per cent of wealthiest claimants, we made a difficult decision to ensure the relief is fiscally sustainable.

“Around 500 claims each year will be impacted and farm-owning couples can pass on up to £3m without paying any inheritance tax - this is a fair and balanced approach.”

Find Out More...

Sir Keir Starmer has also been criticised for avoiding protesters at the Welsh Labour conference by "sneaking out the back" rather than facing farmers who are angry about inheritance tax changes.

Hundreds of farmers gathered with tractors outside the conference venue in Llandudno to voice their dismay at the changes unveiled in Rachel Reeves' first Budget.

Farmer Gareth Wyn Jones told GB News: "They don't understand the importance of agriculture, farming and food production. If they did, they wouldn't have put this inheritance tax on small family farms.

"Starmer stood in the NFU conference in February and told everybody how he was going to protect family farms.

"The first Budget comes out and he drops the biggest bombshell ever. We should challenge him.

LATEST DEVELOPMENTS

- Migrant allowed to stay in UK despite sexually assaulting relatives as deportation would breach 'right to family life'

- Labour prepares emergency plans to keep food on supermarket shelves if farmers strike

- UK snow: Met Office yellow alert in force TODAY as cold air sweeps from north

"On Saturday where the Welsh Labour Conference was, he was there. There were hundreds of farmers and I was one of them. We waited for him outside to come and address and talk to us to aired our frustrations, but he didn't.

"He snuck out the back. That is really, really poor form. He's spending more times on airplanes all over the world instead of sorting out the problems he's got in this country.

"I'm telling you something. There is some big problems coming up from food shortages.

"This is the biggest worry for us as farmers, being able to afford to be able to feed the poor people in society, and that is going to be a problem."

Despite the protests, Starmer defended his position at the conference, saying he would "defend the tough decisions that would be necessary to stabilise our economy".

He insisted the Budget measures were needed to "face up to the harsh light of fiscal reality".

Treasury data suggests around three-quarters of farmers will pay nothing in inheritance tax under the new rules.

However, farmers have challenged these figures, citing Department for Environment Food and Rural Affairs data indicating 66 per cent of farm businesses are worth more than the £1million threshold.

Experts warn the new rules will create an unfair divide, with private sector workers' pension inheritances facing a 40 per cent tax charge while public sector pensions remain exempt.

Ian Cook of wealth manager Quilter warned the changes could have "devastating" consequences for dependent partners.

The Tax Payers Alliance criticised the growing unfairness, saying "private sector workers are sick of picking up the bill for gold-plated public sector pensions."

A government spokesperson said: “With public services crumbling, a £22bn fiscal hole inherited from the previous government and 40 per cent of Agricultural Property Relief going to the 7 per cent of wealthiest claimants, we made a difficult decision to ensure the relief is fiscally sustainable.

“Around 500 claims each year will be impacted and farm-owning couples can pass on up to £3m without paying any inheritance tax - this is a fair and balanced approach.”

Find Out More...