Felix Reeves

Guest Reporter

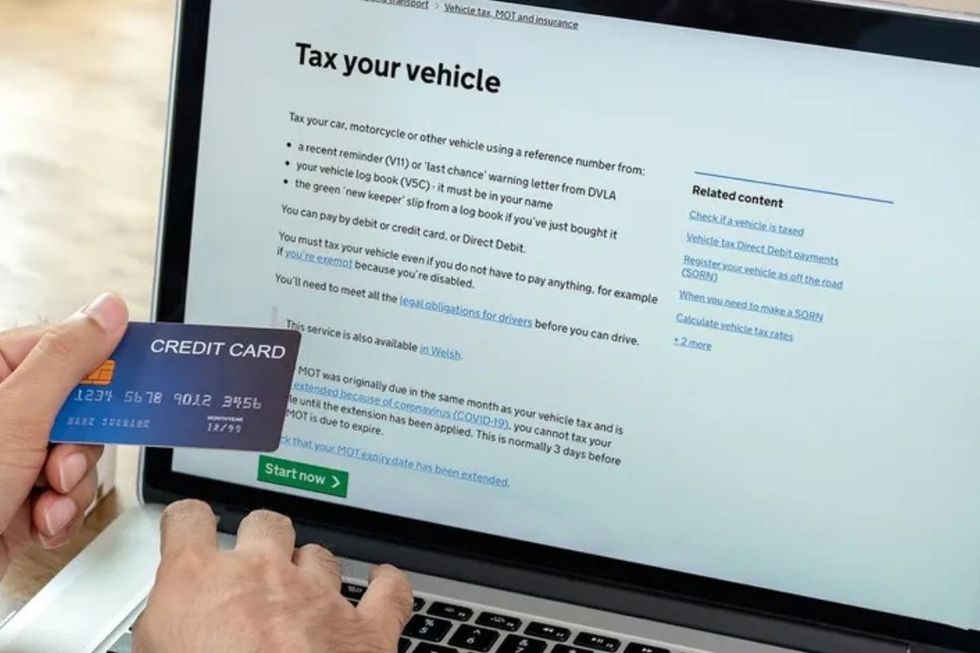

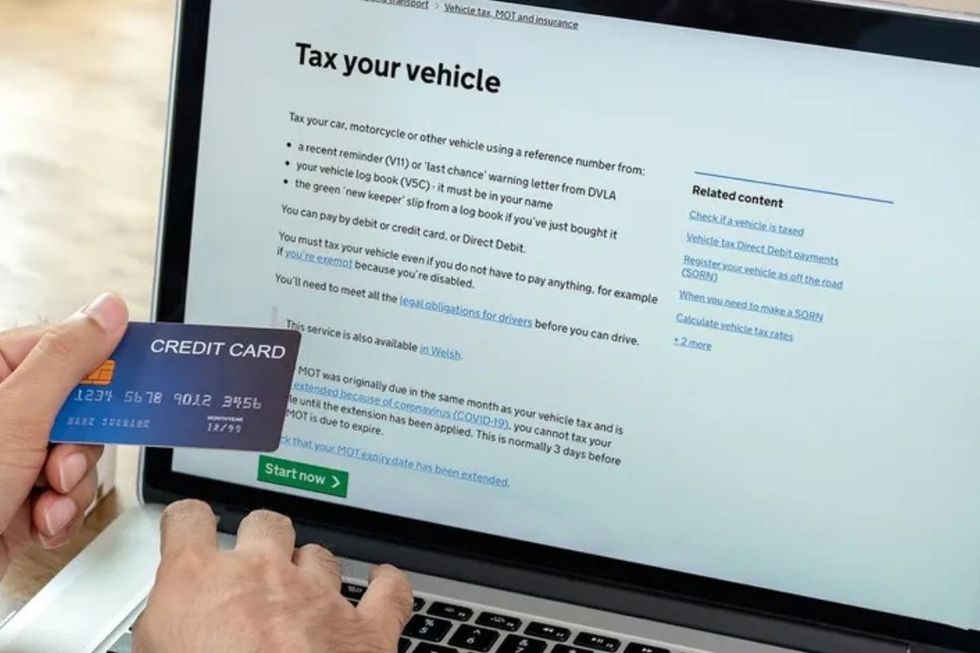

Certain motorists around the UK could face higher car tax hikes depending on where they live, with the average vehicle owner paying more from April 2025.

New data suggests that drivers in Mid Ulster, Northern Ireland, are set to face the highest car tax increases in the UK, with an average rise of £689 per vehicle next year.

The hike comes as part of new Vehicle Excise Duty (VED) rates announced in the Autumn Budget by Chancellor Rachel Reeves in October.

The new research reveals the impact will vary significantly across different regions, based on the types of vehicles typically purchased in each area.

Do you have a story you'd like to share? Get in touch by emailing [email protected]

While the tax rates themselves don't vary by location, data shows that motorists in Mid Ulster will bear the heaviest burden due to their choice of vehicles with higher CO2 emissions.

The findings are based on Department for Transport data examining new private vehicle registrations in the first half of the 2024 tax year.

Inner London drivers will face the second-highest tax increase, with VED set to rise by £625 per vehicle, despite the Ultra Low Emission Zone (Ulez), indicating that motorists may prefer to pay daily charges instead of switching to electric vehicles.

The £625 rise in Inner London stands nearly £100 higher than the next most affected area.

At a regional level, London and Northern Ireland will experience the steepest VED increases overall.

The average tax rise across all of London will be £475 per car, while Northern Ireland drivers face an extra £454.

In contrast, the North East will see the lowest increases, with drivers paying an additional £384 per car on average. Welsh drivers will see prices rise by just under £400.

Tom Banks, car insurance expert at Go.Compare, said: "The increased VED rates mean most new car buyers will be paying a lot more than they were expecting in 2025.

"If you live in a region where buyers tend to go for high CO2 cars, then drivers in your area will be the most impacted by the rise.

"But, if you're worried about how the changes will affect you, there are ways to minimise the impact on your finances."

Other parts of Northern Ireland also feature prominently among the areas most affected by the VED changes, with Fermanagh and Omagh drivers seeing an average increase of £502 per vehicle if current buying trends continue.

Vehicle owners in the Newry, Mourne and Down region face similar rises, with tax increases averaging £494 per car.

LATEST DEVELOPMENTS:

Banks added that drivers could save on the expensive car tax hikes by purchasing a vehicle which produces zero or low rates of emissions.

He said: "If you can't purchase a suitable hybrid or EV, you could opt for a nearly new motor instead. This gives you that new car feeling for a fraction of the price, and will allow you to dodge the increased tax."

Find Out More...

New data suggests that drivers in Mid Ulster, Northern Ireland, are set to face the highest car tax increases in the UK, with an average rise of £689 per vehicle next year.

The hike comes as part of new Vehicle Excise Duty (VED) rates announced in the Autumn Budget by Chancellor Rachel Reeves in October.

The new research reveals the impact will vary significantly across different regions, based on the types of vehicles typically purchased in each area.

Do you have a story you'd like to share? Get in touch by emailing [email protected]

While the tax rates themselves don't vary by location, data shows that motorists in Mid Ulster will bear the heaviest burden due to their choice of vehicles with higher CO2 emissions.

The findings are based on Department for Transport data examining new private vehicle registrations in the first half of the 2024 tax year.

Inner London drivers will face the second-highest tax increase, with VED set to rise by £625 per vehicle, despite the Ultra Low Emission Zone (Ulez), indicating that motorists may prefer to pay daily charges instead of switching to electric vehicles.

The £625 rise in Inner London stands nearly £100 higher than the next most affected area.

At a regional level, London and Northern Ireland will experience the steepest VED increases overall.

The average tax rise across all of London will be £475 per car, while Northern Ireland drivers face an extra £454.

In contrast, the North East will see the lowest increases, with drivers paying an additional £384 per car on average. Welsh drivers will see prices rise by just under £400.

Tom Banks, car insurance expert at Go.Compare, said: "The increased VED rates mean most new car buyers will be paying a lot more than they were expecting in 2025.

"If you live in a region where buyers tend to go for high CO2 cars, then drivers in your area will be the most impacted by the rise.

"But, if you're worried about how the changes will affect you, there are ways to minimise the impact on your finances."

Other parts of Northern Ireland also feature prominently among the areas most affected by the VED changes, with Fermanagh and Omagh drivers seeing an average increase of £502 per vehicle if current buying trends continue.

Vehicle owners in the Newry, Mourne and Down region face similar rises, with tax increases averaging £494 per car.

LATEST DEVELOPMENTS:

- Driving law changes you may have missed in December - HMRC updates, new car insurance rules and more

- Ford risks £100million fine for not meeting electric car goals amid struggle to scrap petrol and diesel

- Elderly drivers with medical conditions may be required to make 'adaptations' to their car

Banks added that drivers could save on the expensive car tax hikes by purchasing a vehicle which produces zero or low rates of emissions.

He said: "If you can't purchase a suitable hybrid or EV, you could opt for a nearly new motor instead. This gives you that new car feeling for a fraction of the price, and will allow you to dodge the increased tax."

Find Out More...