Akshay Raja

Guest Reporter

Britain’s net zero drive has made families poorer, according to new research that suggests there is a trade-off between net zero and economic growth.

Analysis by the UK investment bank Peel Hunt suggests there is a direct correlation between living standards and energy consumption.

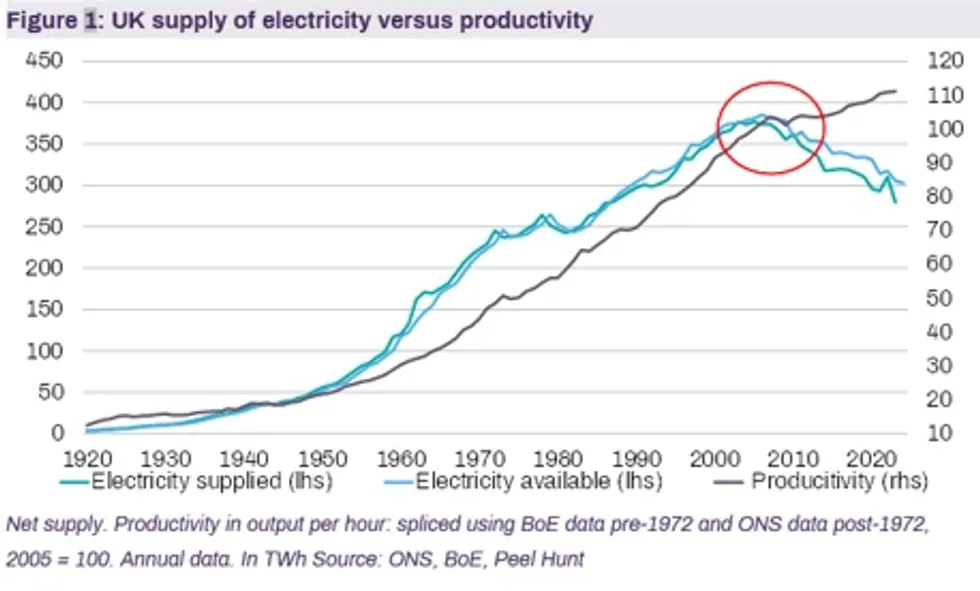

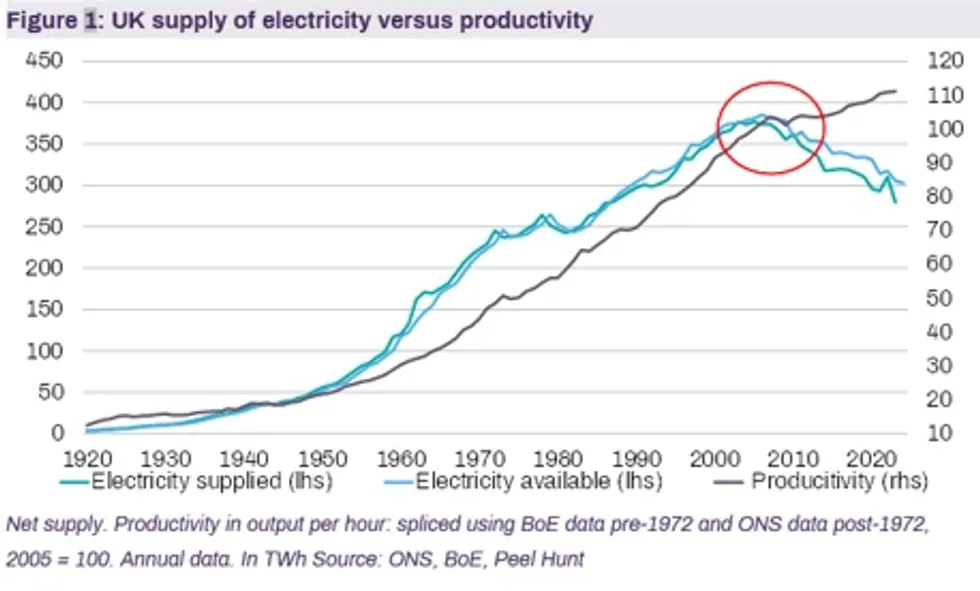

It points to how the reduction in supply of UK electricity from 2006 coincided with period of weak productivity growth, and the UK’s decarbonisation efforts appear to be causing weak economic growth and high energy prices.

As productivity growth in the UK has slowed in the last two decades, economic performance and living standards have been affected.

The report states: “If an economy throttles its production of energy, it impairs its capacity to produce all types of goods and services. Productivity is the major driver of per capita GDP.”

According to the research, there is a positive trend between per capita GDP (used as a measure of living standards) and per capita energy consumption.

Between 1990 and 2022, UK energy consumption per capita fell by a total of 32.5 per cent.

UK electricity supply peaked in 2005, when UK energy per capita was 50 per cent of the US level, and living standards were around 79 per cent of the US level.

By 2022, per capita energy consumption fell to around 38 per cent of the US level along with a simultaneous fall in living standards to 74 per cent of the US level.

Peel Hunt’s research projects Poland and South Korea will overtake UK in living standards by 2030, as their per capita energy consumption continues to grow.

According to Peel Hunt’s analysis, the UK’s productivity is directly correlated to its electricity supply. As available electricity increased in the UK between 1920 and 2005, productivity increased by 700 per cent.

Contrastingly, as electricity availability has fallen by 21 per cent since 2005, UK productivity growth has slowed.

As electricity production facilities have been decommissioned, UK energy capacity has been reduced without replacement, and overall electricity availability has reduced.

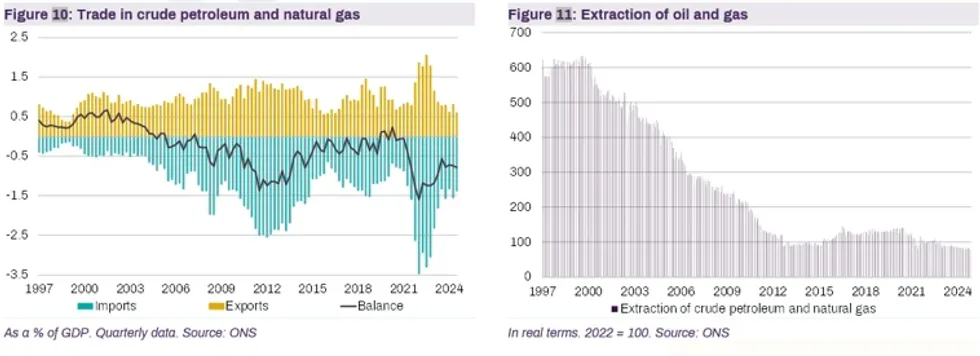

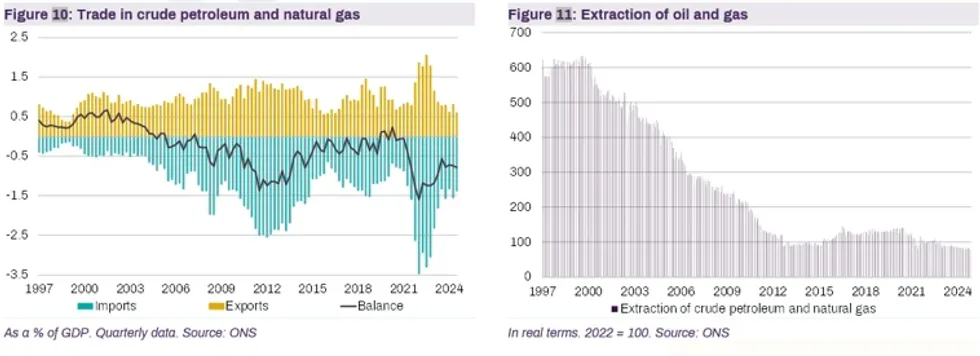

The report further highlights how net zero has led to Britain transforming from being a net exporter of oil and gas to a net importer. It highlights the trade balance in oil and gas has fallen from +0.5 per cent of UK GDP at the start of the century, to around -1.0 per cent.

As total output of oil and gas has fallen by almost 90 per cent in the UK since 1999, the country has become dependent on foreign supplies and is now vulnerable to shocks affecting the supply of external energy, such as that caused by Russia’s invasion of Ukraine in 2022 which caused economic activity in the UK to stall for two years.

Peel Hunt warned: "Whenever global oil and gas prices surge, the UK has to pay even more to foreign producers which drags on real GDP via a deterioration in the balance of trade.

"Previously, when the UK was a net exporter of oil and gas, rising prices would have a positive effect on the trade balance, while higher costs of energy for consumers and businesses showed up as a de facto transfer to energy producers as their incomes increased."

As the UK has become more energy efficient, less energy is now required to fuel economic activity, but there has not been a simultaneous decline in demand for energy.

Rather, rising energy prices show that there has contrastingly been a greater decline in energy supply relative to demand.

Rising energy prices lead to de-industrialisation- because economic activity is fuelled by energy, more goods and services can be produced at competitive prices when there is a greater supply of cheap energy.

Over the past 20 years, UK energy prices have risen sharply relative to other countries and in 2023, the UK had the highest domestic electricity prices in the International Energy Agency- 80 per cent above the average price according to Peel Hunt’s analysis.

Looking forward, the Department for Energy Security and Net Zero has projected a roughly 60 per cent rise in electricity supply by 2050 relative to 2024 - the majority of which will come from renewables such as wind, solar, and gas.

Energy Secretary Ed Miliband has said the push towards more renewable energy sources will help to create new jobs and bring down energy bills.

He said earlier this year when launching the Government's net zero council: "Businesses and leaders across our country recognise that clean power and accelerating towards net zero represents the economic opportunity of the 21st century.

"It is one which will protect bills, create jobs, and tackle the climate crisis. This Council is about mission-driven leadership, bringing government, business and civil society together to turn ambition into action.

"By working in partnership, we can drive the investment, innovation and industrial transformation needed to make the UK a clean energy superpower."

Find Out More...

Analysis by the UK investment bank Peel Hunt suggests there is a direct correlation between living standards and energy consumption.

It points to how the reduction in supply of UK electricity from 2006 coincided with period of weak productivity growth, and the UK’s decarbonisation efforts appear to be causing weak economic growth and high energy prices.

As productivity growth in the UK has slowed in the last two decades, economic performance and living standards have been affected.

The report states: “If an economy throttles its production of energy, it impairs its capacity to produce all types of goods and services. Productivity is the major driver of per capita GDP.”

According to the research, there is a positive trend between per capita GDP (used as a measure of living standards) and per capita energy consumption.

Between 1990 and 2022, UK energy consumption per capita fell by a total of 32.5 per cent.

UK electricity supply peaked in 2005, when UK energy per capita was 50 per cent of the US level, and living standards were around 79 per cent of the US level.

By 2022, per capita energy consumption fell to around 38 per cent of the US level along with a simultaneous fall in living standards to 74 per cent of the US level.

Peel Hunt’s research projects Poland and South Korea will overtake UK in living standards by 2030, as their per capita energy consumption continues to grow.

According to Peel Hunt’s analysis, the UK’s productivity is directly correlated to its electricity supply. As available electricity increased in the UK between 1920 and 2005, productivity increased by 700 per cent.

Contrastingly, as electricity availability has fallen by 21 per cent since 2005, UK productivity growth has slowed.

As electricity production facilities have been decommissioned, UK energy capacity has been reduced without replacement, and overall electricity availability has reduced.

The report further highlights how net zero has led to Britain transforming from being a net exporter of oil and gas to a net importer. It highlights the trade balance in oil and gas has fallen from +0.5 per cent of UK GDP at the start of the century, to around -1.0 per cent.

As total output of oil and gas has fallen by almost 90 per cent in the UK since 1999, the country has become dependent on foreign supplies and is now vulnerable to shocks affecting the supply of external energy, such as that caused by Russia’s invasion of Ukraine in 2022 which caused economic activity in the UK to stall for two years.

Peel Hunt warned: "Whenever global oil and gas prices surge, the UK has to pay even more to foreign producers which drags on real GDP via a deterioration in the balance of trade.

"Previously, when the UK was a net exporter of oil and gas, rising prices would have a positive effect on the trade balance, while higher costs of energy for consumers and businesses showed up as a de facto transfer to energy producers as their incomes increased."

As the UK has become more energy efficient, less energy is now required to fuel economic activity, but there has not been a simultaneous decline in demand for energy.

Rather, rising energy prices show that there has contrastingly been a greater decline in energy supply relative to demand.

Rising energy prices lead to de-industrialisation- because economic activity is fuelled by energy, more goods and services can be produced at competitive prices when there is a greater supply of cheap energy.

Over the past 20 years, UK energy prices have risen sharply relative to other countries and in 2023, the UK had the highest domestic electricity prices in the International Energy Agency- 80 per cent above the average price according to Peel Hunt’s analysis.

Looking forward, the Department for Energy Security and Net Zero has projected a roughly 60 per cent rise in electricity supply by 2050 relative to 2024 - the majority of which will come from renewables such as wind, solar, and gas.

Energy Secretary Ed Miliband has said the push towards more renewable energy sources will help to create new jobs and bring down energy bills.

He said earlier this year when launching the Government's net zero council: "Businesses and leaders across our country recognise that clean power and accelerating towards net zero represents the economic opportunity of the 21st century.

"It is one which will protect bills, create jobs, and tackle the climate crisis. This Council is about mission-driven leadership, bringing government, business and civil society together to turn ambition into action.

"By working in partnership, we can drive the investment, innovation and industrial transformation needed to make the UK a clean energy superpower."

Find Out More...